South Carolina has not developed a state base minimum wage. Because many companies and staff members in South Carolina go through the federal Fair Labor Standards Act, the base pay stated because regulation would generally use. Presently, the federal base pay is $7.25. South Carolina does not have regulation on minimum wage for regular and tipped employee.

State of South Carolina Payroll Law for

South Carolina does not have any legislation determining when or how regularly a company should pay staff members their salaries. Companies should inform workers at the time of hire of the typical hours and the agreed-upon wages, the time and location of payment, and the reductions made from salaries, consisting of insurance coverage payments. Companies have the alternative of offering composed notice by publishing the terms notably at or near the workplace.

South Carolina companies need to keep state earnings taxes from salaries paid to nonresidents for services carried out within South Carolina. Citizens working outside of South Carolina also need to keeping for that income.

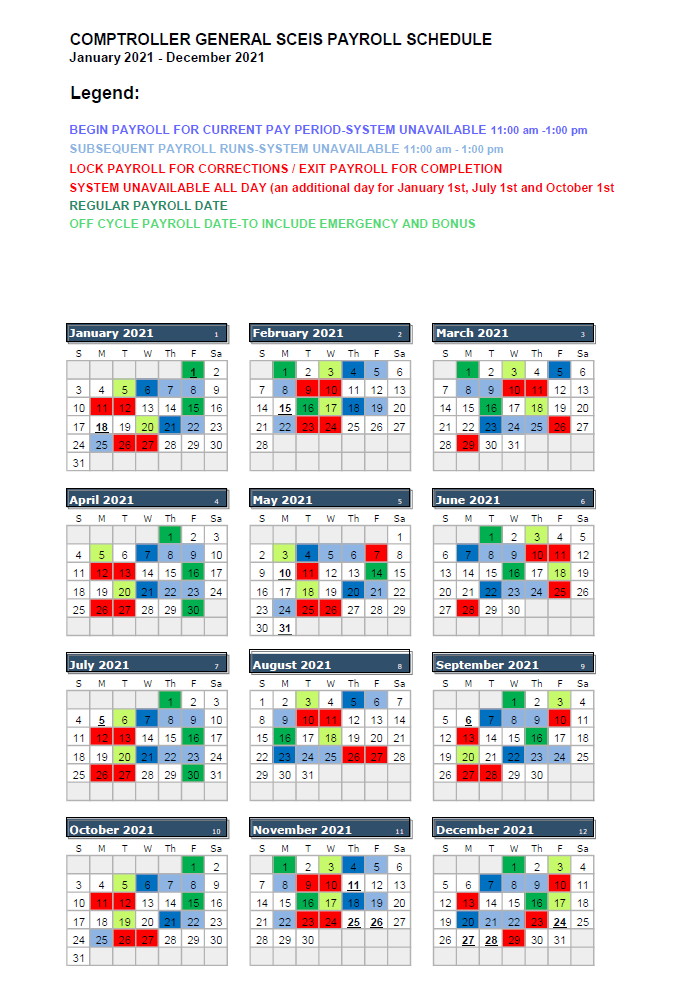

State of South Carolina Payroll Calendar 2025

State of South Carolina Payroll Calendar 2025