Rhode Island is a “Joint Application” Region. One program for TWO ID numbers (SUI and SIT). Rhode Island required overtime payout. Under Rhode Island’s minimum law, an employer should pay a minimum of $10.50 per hour and $3.89 per hour for a tipped worker. Company in Rhode Island needs to furthermore adhere to federal base pay regulations that presently determine the federal base pay at $7.25.

If a company opt in to pay workers a minimum wage. then the company needs to pay those workers according to minimum wage regulation, either federal or state, leading to the staff members being paid the greater wage. In many circumstances in Rhode Island, the base pay will ensure a greater wage rate for workers than federal regulation.

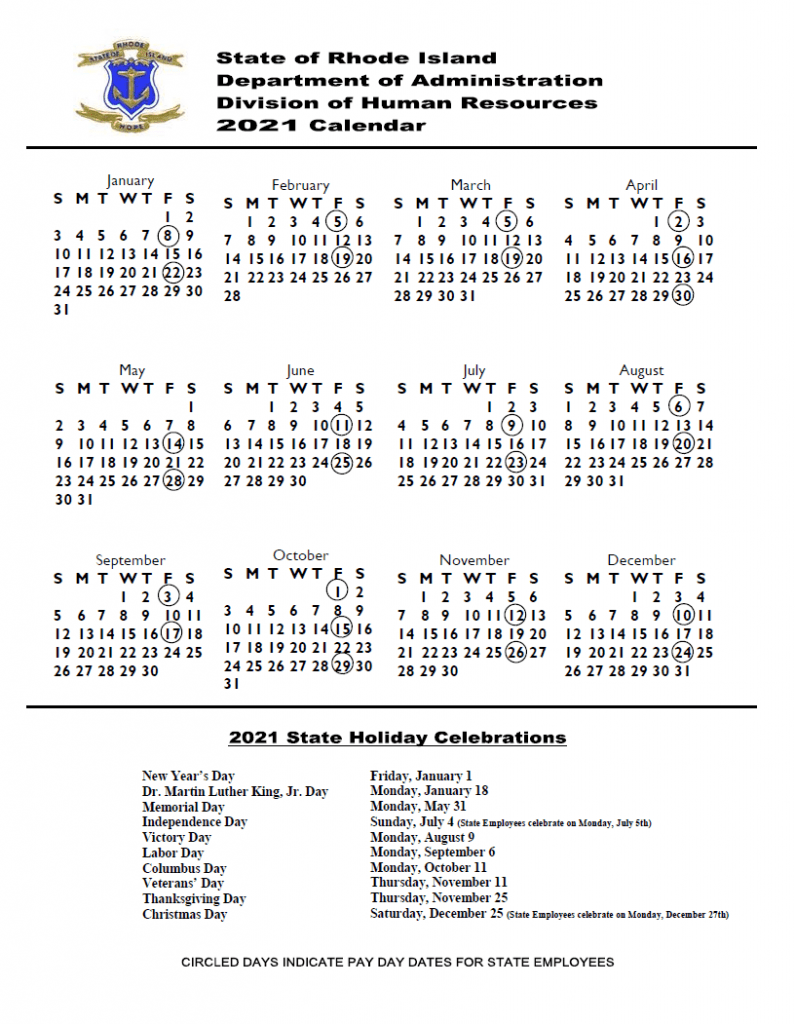

State of Rhode Island Payroll Calendar Schedule

A company should pay its staff members weekly, other than those who are paid out a fixed biweekly, semi-monthly, regular monthly, or annual rate. Hourly workers need to be paid once a week. A company should develop a regular payday and need to inform workers of an arranged payday adjustment a minimum of 3 paydays beforehand. A company needs to pay staff members within nine (9) days of completing the pay period. If a payday falls on a holiday, a company might pay its workers on the day following the holiday.

Print State of Rhode Island Payroll Calendar 2025

State of Rhode Island Payroll Calendar 2025