Printable 1099 NEC Form 2025 – Form 1099-NEC stands as a vital document. Its central role is reporting non-employee compensation, making it a key instrument for independent contractors, freelancers, and businesses.

What is Form 1099-NEC?

Form 1099-NEC, or the “Nonemployee Compensation” form, is a tax form issued by the United States Internal Revenue Service (IRS). This form effectively replaced Box 7 on Form 1099-MISC as the primary method for reporting non-employee compensation beginning from the tax year 2025.

Who Needs Form 1099-NEC?

The Form 1099-NEC is a crucial piece of paperwork for individuals and businesses paying for non-employee services. These include independent contractors, freelancers, and other self-employed professionals who have earned more than $600 within a tax year. As such, the payers are responsible for preparing and issuing Form 1099-NEC.

The Purpose of Form 1099-NEC

The Form 1099-NEC records the income earned by independent contractors and non-employees. The primary goal is to ensure accurate and transparent tax reporting, fostering an environment of compliance and financial transparency.

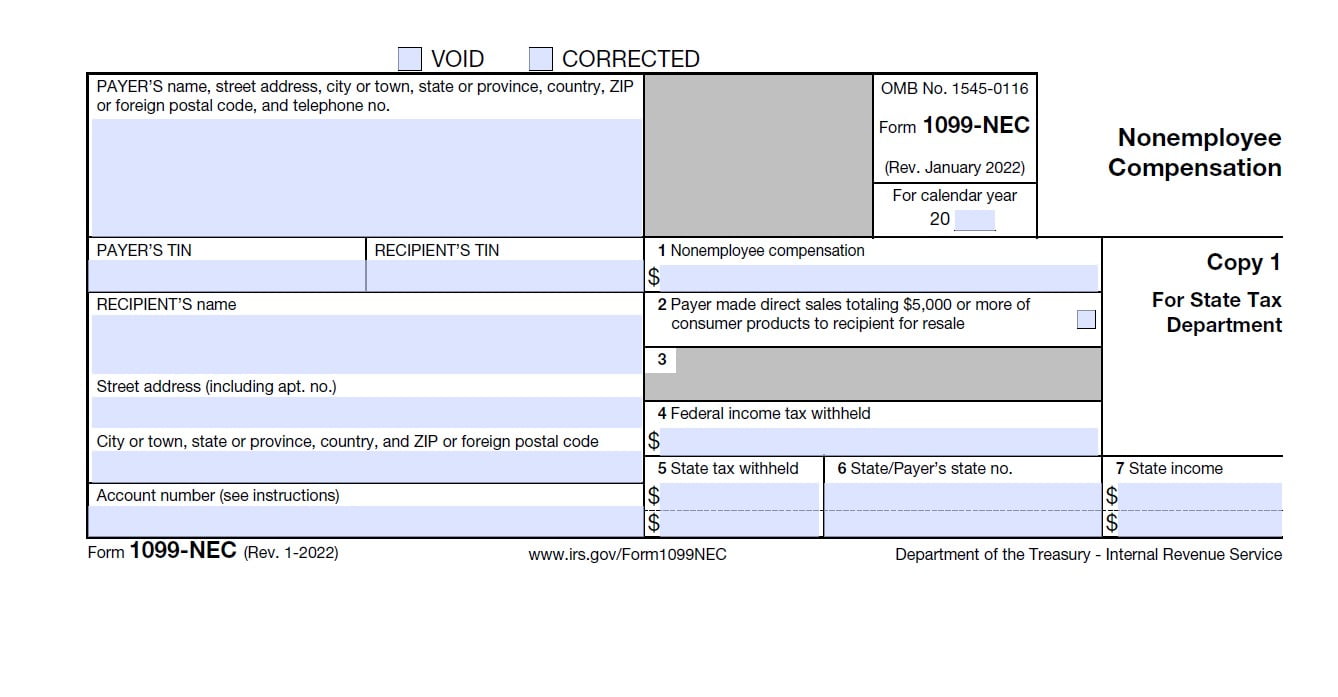

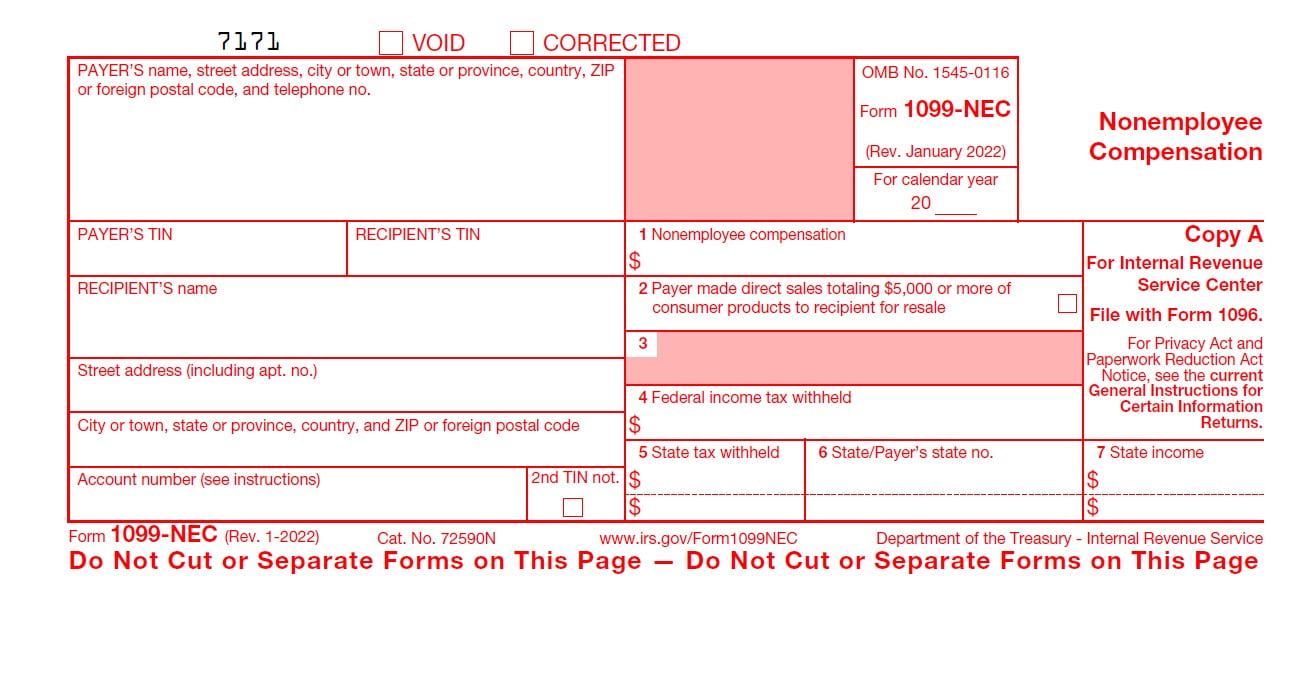

The Breakdown of Form 1099-NEC

The Form 1099-NEC comprises several sections, each holding specific and pertinent information. Here is a detailed breakdown:

- The payer’s information includes the payer’s name, address, and taxpayer identification number (TIN).

- Recipient’s information: The recipient’s name, address, and TIN are required here.

- Boxes 1 to 7: These boxes report various forms of compensation and federal tax withholdings, with Box 1 being the most commonly used for nonemployee compensation over $600.

- State income and withholding: State income and tax withholding information are reported in boxes 16 to 18.

Importance of Timely Filing

For businesses, the timely filing of Form 1099-NEC is crucial. The IRS imposes penalties for late submissions, increasing over time. Moreover, failure to file can also lead to difficulties in future financial and tax audits.

Form 1099-NEC plays an instrumental role in the financial ecosystem of the United States. For the independent contractor, it acknowledges their earnings. For the business, it’s evidence of responsible financial dealings. And for the IRS, it’s essential for ensuring compliance with tax laws. By understanding the nature and details of Form 1099-NEC, individuals and businesses can navigate their financial obligations with confidence and clarity.

Print and Save Printable 1099 NEC Form 2025

Get your form HERE