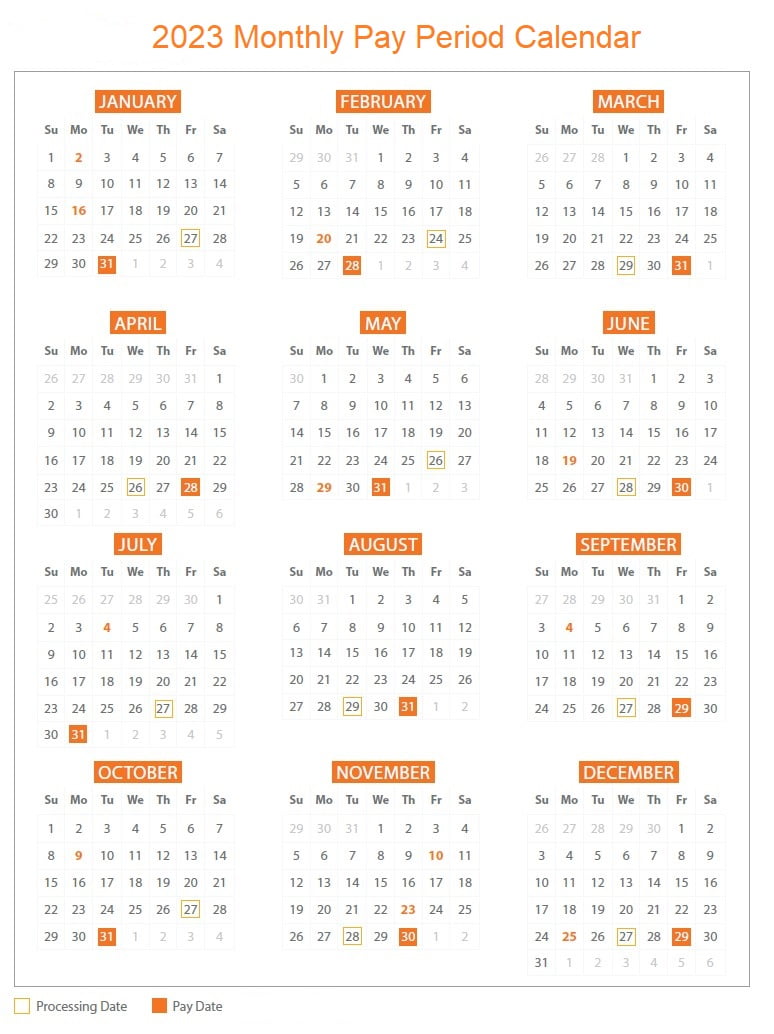

2025 Payroll Calendar – A pay period calendar is a schedule that outlines the dates for an organization’s pay periods. It specifies the start and end dates of each pay period and the corresponding pay dates for employees. The frequency of pay periods may vary depending on state regulations, company policies, or the type of industry. Some organizations may use a bi-weekly pay period calendar, while others may use a semi-monthly or weekly pay period calendar. By using a pay period calendar, employees can anticipate when they will receive their paychecks, and employers can manage their payroll processes more efficiently.

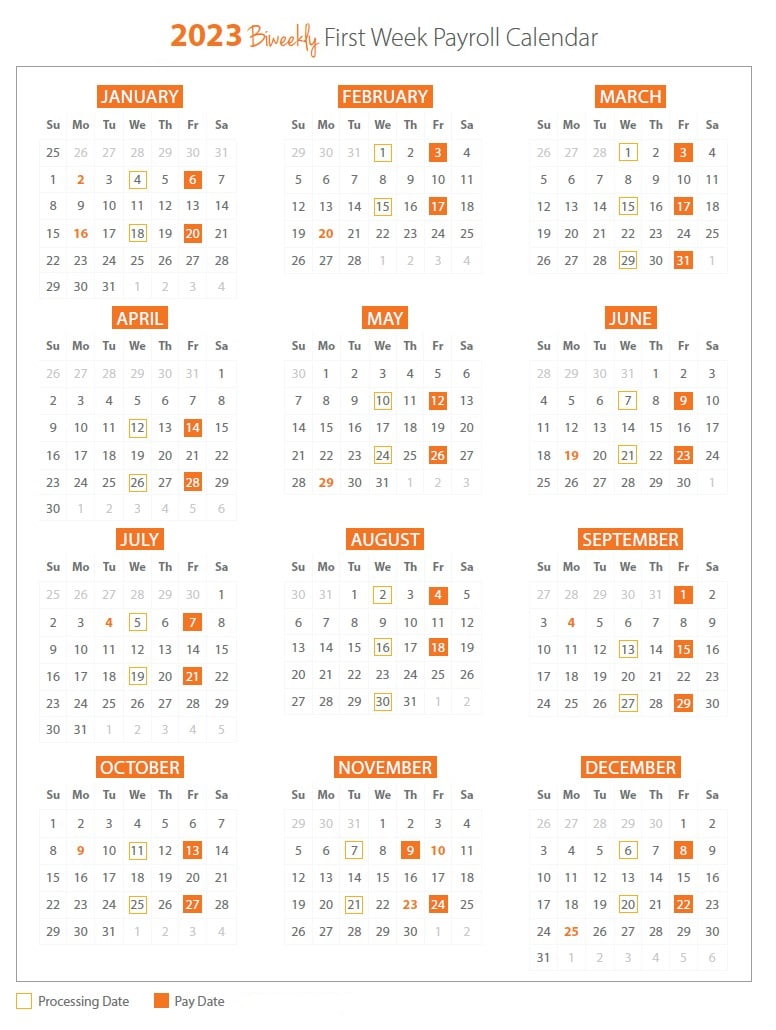

For the year 2025, if you’re responsible for overseeing a standard biweekly pay system, your biweekly-paid employees (except freelancer, if you are freelancer, you will need W9 Form) will receive a total of 26 paychecks. Specifically, they will receive two paychecks in ten out of the twelve months, and in the remaining two months, they will receive three paychecks each.

When the initial paycheck in January is issued on the 6th, additional paychecks will be given out in June and September, resulting in three extra pay periods. However, if the first paycheck in January is distributed on the 13th instead, there will be an additional paycheck given out in both July and December.

The majority of company in USA pay biweekly salary, that mean if you are paid biweekly, you will have 26 pay checks. If you paid twice a month you will have 24 paychecks.

Top 50 Company Payroll Calendar Schedule

| Companies | Sector | Payroll Schedule |

|---|---|---|

| Walmart | Retail | Biweekly |

| Amazon | Retail | Biweekly |

| Apple | Technology | Biweekly |

| CVS Health | Health Care | Biweekly |

| UnitedHealth Group | Health Care | Biweekly |

| Exxon Mobil | Energy | Weekly |

| Berkshire Hathaway | Financial | |

| Alphabet | Technology | |

| McKesson | Health Care | Biweekly |

| AmerisourceBergen | Health Care | Biweekly |

| Costco Wholesale | Retail | Biweekly |

| Cigna | Health Care | Biweekly |

| AT&T | Telecommunication | Biweekly |

| Microsoft | Technology | Biweekly |

| Cardinal Health | Health Care | Biweekly |

| Chevron | Energy | Weekly |

| Home Depot | Retail | Biweekly |

| Walgreens Boots | Food & Drug Stores | Biweekly |

| Marathon Petroleum | Energy | Biweekly |

| Elevance Health | Health Care | Weekly |

| Kroger | Food & Drug Stores | Weekly |

| Ford Motor | Motor Vehicles & Parts | Twice Monthly |

| Verizon Communications | Telecommunication | Every Two Week |

| JPMorgan Chase | Financial | Biweekly |

| General Motors | Motor Vehicles & Parts | Weekly |

| Centene | Health Care | Biweekly |

| Comcast | Telecommunication | Biweekly |

| Phillips 66 | Energy | Biweekly |

| Valero Energy | Energy | Every Two Week |

| Dell Technologies | Technology | Biweekly |

| Target | Retail | Weekly |

| Fannie Mae | Financial | Biweekly |

| United Parcel Service | Transportation | Weekly |

| Lowe’s | Retail | biweekly |

| Bank of America | Financial | Biweekly |

| Johnson & Johnson | Health Care | Biweekly |

| FedEx | Transportation | Weekly |

| Humana | Health Care | Biweekly |

| Wells Fargo | Financial | Biweekly |

| State Farm Insurance | Financial | Biweekly |

| Pfizer | Health Care | Twice Monthly |

| Citigroup | Financials | Every Two Week |

| Procter & Gamble | Retail | Monthly |

| Albertsons | Food & Drug Stores | Weekly |

Biweekly: 52 weeks ÷ 2 = 26 paychecks

Twice a month: 12 months × 2 = 24 paychecks

Here are the three paycheck months that I’ve identified for 2025:

In case your initial payment for 2025 falls on Friday, January 6, then you should anticipate receiving three paychecks in March and September

In case your initial payment for 2025 falls on Friday, January 13, then you should anticipate receiving three paychecks in June and December

List of Every Friday Biweekly Payday in 2025

| First Paycheck of 2025: Friday, January 6 | First Paycheck of 2025: Friday, January 13 |

|---|---|

| January 6, 2025 | January 13, 2025 |

| January 20, 2025 | January 27, 2025 |

| February 3, 2025 | February 10, 2025 |

| February 17, 2025 | February 24, 2025 |

| March 3, 2025 | March 10, 2025 |

| March 17, 2025 | March 24, 2025 |

| March 31, 2025 | April 7, 2025 |

| April 14, 2025 | April 21, 2025 |

| April 28, 2025 | May 5, 2025 |

| May 12, 2025 | May 19, 2025 |

| May 26, 2025 | June 2, 2025 |

| June 9, 2025 | June 16, 2025 |

| June 23, 2025 | June 30, 2025 |

| July 7, 2025 | July 14, 2025 |

| July 21, 2025 | July 28, 2025 |

| August 4, 2025 | August 11, 2025 |

| August 18, 2025 | August 25, 2025 |

| September 1, 2025 | September 8, 2025 |

| September 15, 2025 | September 22, 2025 |

| September 29, 2025 | October 6, 2025 |

| October 13, 2025 | October 20, 2025 |

| October 27, 2025 | November 3, 2025 |

| November 10, 2025 | November 17, 2025 |

| November 24, 2025 | December 1, 2025 |

| December 8, 2025 | December 15, 2025 |

| December 22, 2025 | December 29, 2025 |

State Pay Period Calendar & Minimum Wages

Although companies usually create their payroll schedule based on their business requirements, there are regulations in place that mandate the minimum level of consistency for these schedules. Therefore, before deciding on a payment schedule, it’s vital to understand the frequency with which employers in your state must process payroll. To find out more about the payroll regulations in your state, refer to our state payroll guides listed below.

| States: | Minimum Pay Frequency | Minimum Wage/Hours |

|---|---|---|

| Alabama | Alabama has no law requiring an employer to provide employees with a pay stub | $7.25 |

| Alaska | Alaska law says thAt you must pay employees monthly or semimonthly, and the employee can decide which they prefer. | $10.34 |

| Arizona | Arizona law requires thAt you pay employees At least twice a month, and cannot be more than 16 days apart | $13.85 |

| Arkansas | Law in Arkansas requires employer to pay employees twice a month. This means you are allowed to pay employees semimonthly, biweekly, or weekly | $11.00 |

| California | At least twice a month | $15.50 |

| Colorado | least once per month | $12.56 |

| Connecticut | At least weekly | $14 |

| Delaware | monthly and no more than seven days from the close of each pay period. | $11.75 |

| Florida | Florida does not mandAte how often you pay employees | $12 |

| Georgia | At least twice per month | 7.25 |

| Hawaii | At least twice a month | $10.10 |

| Idaho | At least once per month | $7.25 |

| Illinois | At least semimonthly and within 13 days following the close of a pay period | $13 |

| Indiana | semimonthly or biweekly and no lAter than 10 business days following the close of the pay period | $7.25 |

| Iowa | At least monthly and regularly spaced. You must pay employees within 12 days | $7.25 |

| Kansas | At least once per calendar month | $7.25 |

| Kentucky | At least twice per month | $7.25 |

| Louisiana | At least twice per month | $7.25 |

| Maine | semiweekly, biweekly, or weekly | $12.75 |

| Maryland | Employees who are not in executive, professional, or administrAtive roles must be paid every two weeks or twice a month | $12.50 |

| Massachusetts | Weekly | $14.25 |

| Michigan | weekly, biweekly, semimonthly, or monthly | $9.87 |

| Minnesota | At least once every 31 days, and all commissions must be paid At least once every three months | $10.33 |

| Mississippi | No regulAtion required employer to pay on specific dAte | $7.25 |

| Missouri | At least twice a month | $12.00 |

| Montana | Montana payroll law does not set a minimum pay frequency, but it stAtes thAt unless otherwise agreed upon, it should be semimonthly. | $9.95 |

| Nebraska | No specific requirement | $10.50 |

| Nevada | Semimonthly | $11.25 |

| New Hampshire | Employees in New Mexico must designAte paydays of no more than 16 days apart | $12 |

| New Jersey | At least twice a month | $15 |

| New Mexico | Employees in New Mexico must designAte paydays of no more than 16 days apart | $11.50 |

| New York | ||

| North Carolina | There are currently no laws in North Carolina thAt designAte a specific form of payroll payment | $7.25 |

| North Dakota | At least once a month on a regularly scheduled pay dAte | $7.25 |

| Ohio | At least twice a month | $9.30 |

| Oklahoma | At least twice each calendar month on regular paydays, | $7.25 |

| Oregon | At least once every 35 days regularly | $13.50 |

| Pennsylvania | At least semimonthly, meaning thAt they are paid two times per month | $13.00 |

| Rhode Island | biweekly or semimonthly as long as every employee is paid a minimum of twice per month | $13.00 |

| South Carolina | there are no regulAtions specifying mandAtory paydays | $7.25 |

| South Dakota | At least once per month and on a regularly scheduled day | $9.95 |

| Tennessee | At least once per month. Employers must also establish and stick to regular pay days | $7.25 |

| Texas | All exempt employees must be paid At least once a month | $7.25 |

| Utah | At least twice per month | $7.25 |

| Vermont | Weekly,within six days of the last pay period | $7.25 |

| Virginia | At least once every two weeks or twice per month. | $12.00 |

| Washington | You must pay employees At least once a month unless federal law specifies a more frequent schedule | $14.49 |

| West Virginia | At least twice every month with no more than 19 calendar days between pay periods. | $8.75 |

| Wisconsin | At least once per month,Each payment must be made within 31 days after the end of a pay period | $7.25 |

| Wyoming | no specifict requirement | $5.15 |