Texas has no state earnings tax, Having said that, companies after all have a variety of things to bear in mind when it comes down to paying workers and gathering taxes from them. Texas’s present base pay is $7.25.

Texas’s minimum wage policy does not use to staff members covered by the Fair Labor Standards Act; therefore, for many companies and workers, minimum wage commitments are governed by the Fair Labor Standards Act. Texas’s present minimum wage for tipped staff members is $2.13.

State of Texas Payroll Law

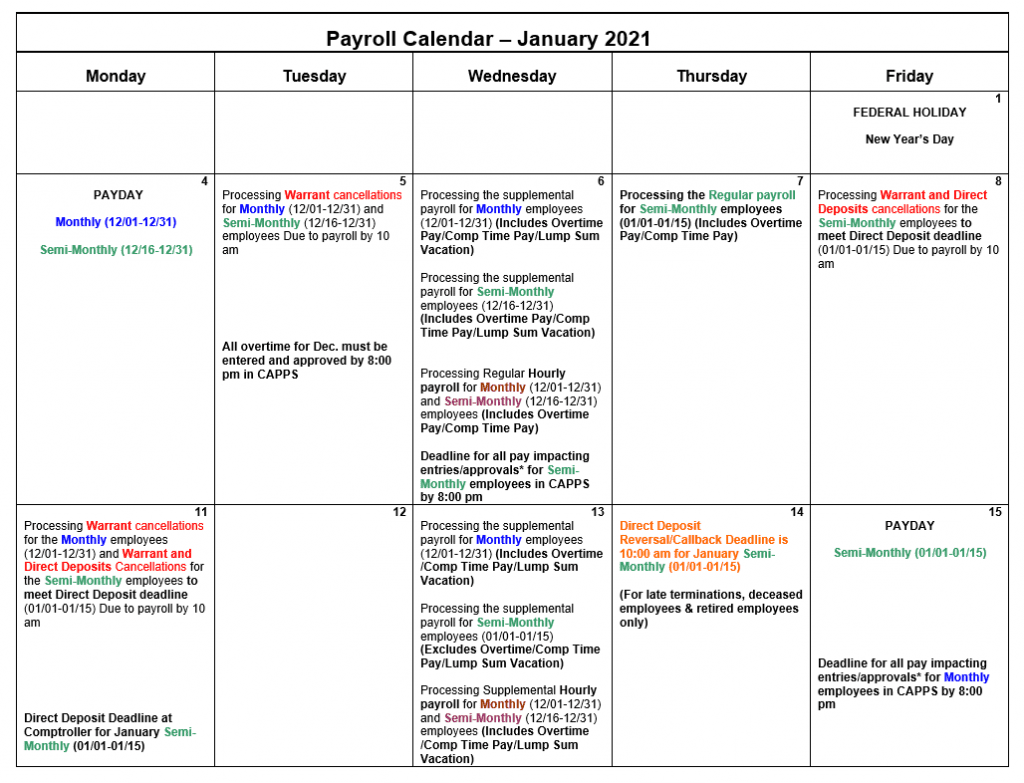

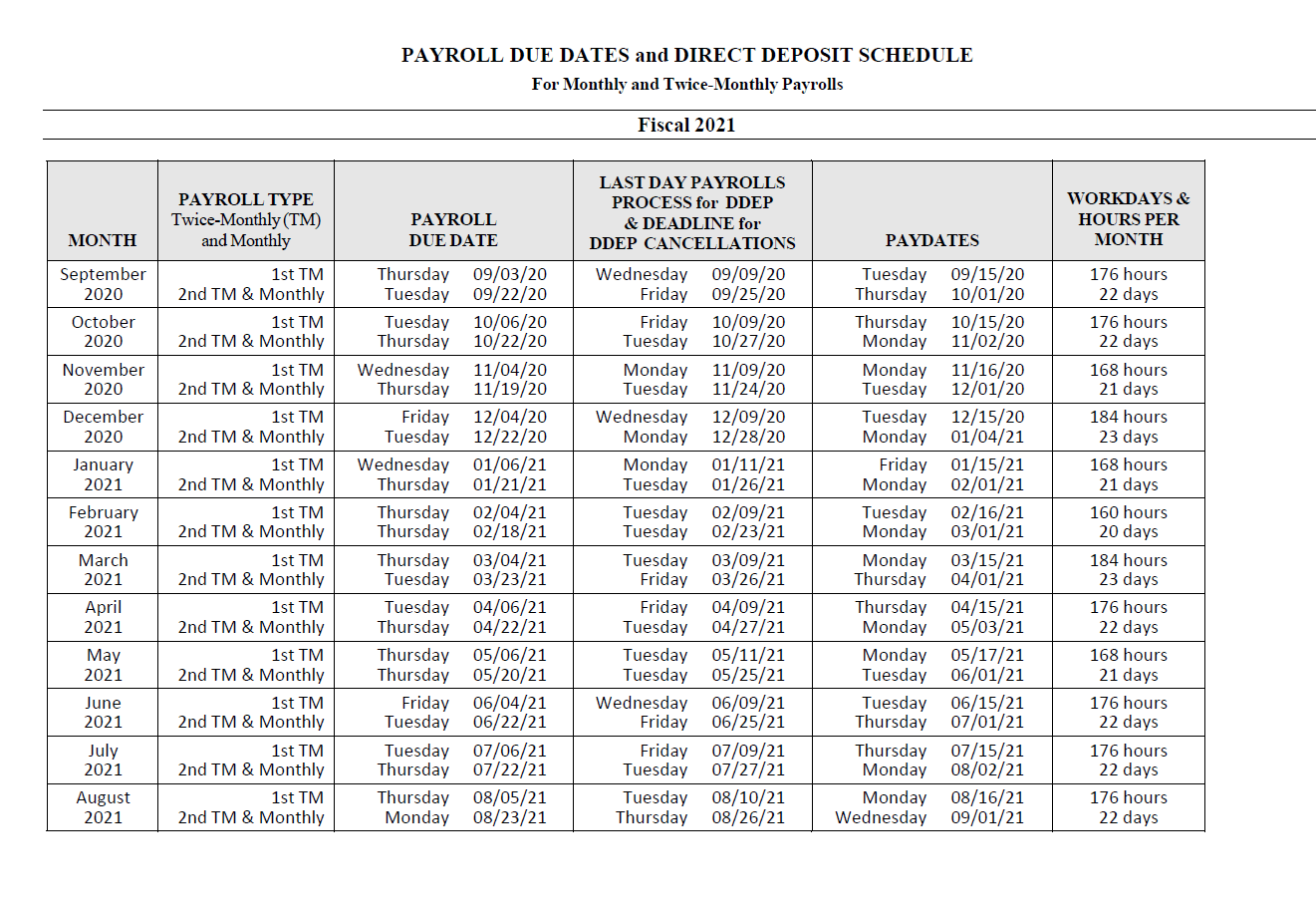

A company needs to pay salaries to each worker who is not exempt from the overtime pay at least two times per month (semi-monthly). A company should pay a staff member exempt from overtime at least as soon as per month. If a company stops working to designate paydays, the company’s paydays are the very first and 15th day of each month.

State of Texas Payroll Calendar 2025

State of Texas Payroll Calendar 2025 Word Monthly