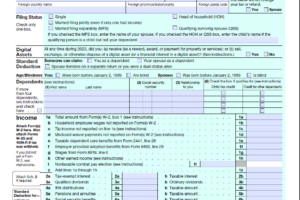

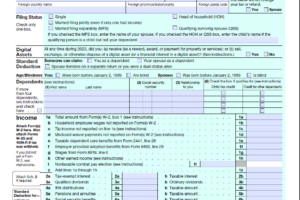

Category: Tax Form

1040 Form 2025 Printable – The IRS Form 1040 is the primary tax form U.S. taxpayers use to file their annual federal income tax return. It is the platform …

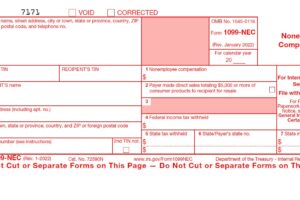

Printable 1099 NEC Form 2025 – Form 1099-NEC stands as a vital document. Its central role is reporting non-employee compensation, making it a key instrument for independent contractors, freelancers, …

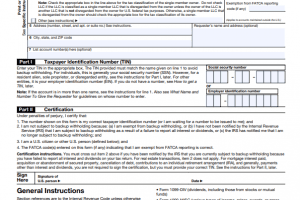

IRS W9 Tax Form – As a freelancer or independent contractor, understanding and managing your taxes is a crucial aspect of your business. One essential tax document you’ll encounter …

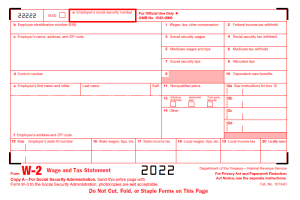

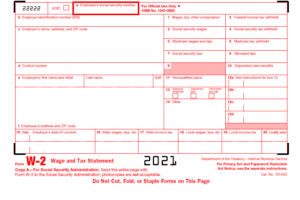

W-2 Employee Information – If the January 31st deadline has passed and you are still waiting for your W-2 from your employer in late February, there are several steps …

Employers must mail out the W-2 forms to each employee or provide 1099 forms to each contract employee by January 31st. This means that they must be postmarked by …

W-2 Instructions – Understanding the W-2 form is essential to understanding tax obligations, both on the employee side as you prepare to file your annual income tax paperwork and …

Walmart W2 Forms for Employees – When you don’t receive your W-2 form from Walmart, or don’t know how to contact Walmart field support, it’s essential that you know …

IRS Refund Processing Time 2025 – After reviewing tax liability and tax payments, the Internal Revenue Service (IRS) prepares federal income tax returns and issues tax refunds. Upon completing your …

W9 Form 2025 Printable – The IRS W9 form is a document that is used by individuals and businesses to provide their Social Security number or taxpayer identification number …

Blank W-9 Form Fillable 2025 – Form W-9 is a few of the most commonly utilized IRS forms. The form is used by taxpayers who are self-employed or working as …