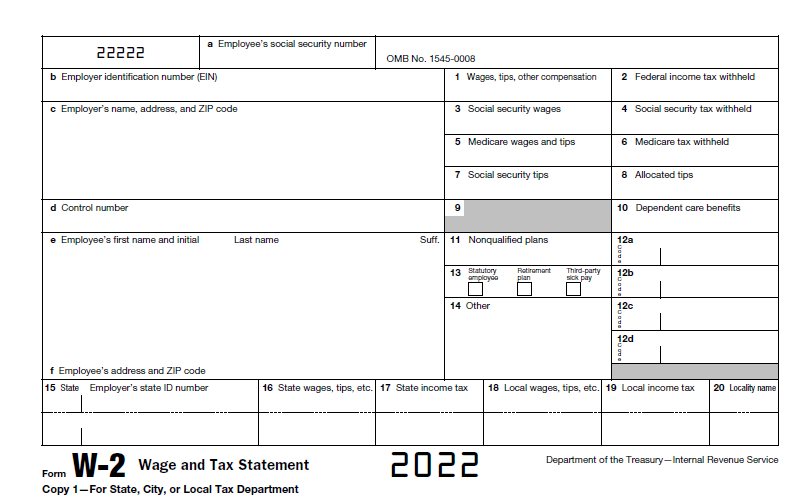

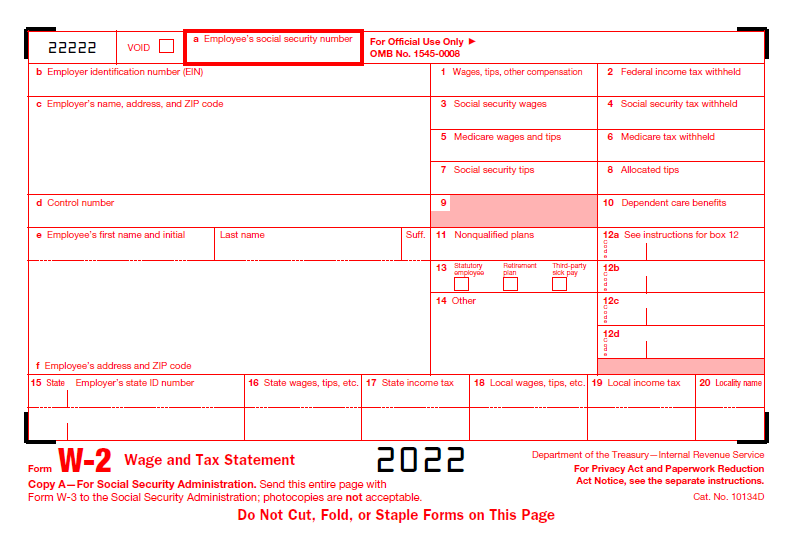

W-2 Instructions – Understanding the W-2 form is essential to understanding tax obligations, both on the employee side as you prepare to file your annual income tax paperwork and on the employer side as you finalize your payroll for the year. With more and more businesses moving to online payroll, it is important to know how to access W-2 forms (online and offline) and read a W-2 correctly. This helpful guide covers all the details (and boxes) relating to wages, tips, commissions, and state, federal, and social security taxes that are withheld. For additional information on filing W-2 forms, visit the IRS website.

W-2 Box 1

This box contains the total amount you have earned in wages or other compensation, minus allowable deductions like pre-tax retirement plans.

The amount entered into Box 1 includes any income you are paid for your services. This earned income includes your wages, stipends, tips, bonuses, commissions, vacation compensation or severance payment, and any other miscellaneous compensation by your employer. Your total wages are not fewer taxes that have been withheld as these are accounted for in a subsequent box. The total amount is what should be entered into Box 1.

W-2 Box 2

This is the total federal income tax that has been withheld from your paychecks for the year.

Federal income tax withholding is based on the self-reported number of dependants provided on your W-4. If you never filed a W-4, the default is single and zero, regardless of your actual status. Paying federal tax is a continuous expectation and tax payments are contributed as your employer pays you. Payment is secured through one of two systems; either a percentage of your wages is deducted from each paycheck, or a cumulative sum is contributed through quarterly estimated tax payments. The quarterly payment is used for individuals who are independent contractors or have income from dividends, capital gains, rental property, or interest.

W-2 Box 3

The total wages (except tips) taxed for Social Security are up to $106,800.

This box represents the total wages subject to the Social Security tax and includes any income earned during the tax year that is not exempt from taxation, such as retirement and some insurance contributions. Because tips are not included in this section, if you are declaring tips (see Box 7), the total amounts in Box 3 and Box 7 should equal the amount listed in Box 1.

W-2 Box 4

This shows the total Social Security tax withheld from your paychecks for the year.

For 2025, wages up to $106,800 are taxed at a rate of 6.2% for employers and employees and 12.4% for independent contractors. The wages included in this number are all earned wages, including Social Security tax on tips. This payroll tax supports the supplemental income support given to all Americans who have paid into the system (based on the Federal Insurance Contribution Act or FICA) once they are eligible to retire from their working lives at age 65.

W-2 Box 5

The box contains the total wages, including tips and commissions taxed for Medicare.

Wages and tips subject to Medicare tax are the same as those eligible for Social Security taxation. However, unlike Social Security, there is no maximum wage.

W-2 Box 6

The total Medicare tax is withheld from your paychecks for the year.

Taxes that contribute to Medicare provide health insurance for individuals over 65 and under 65 with certain disabilities. This health insurance program contains two parts, hospital insurance, and medical insurance. Hospital insurance is free to all Medicare recipients, and medical insurance usually involves a co-pay by the individual. This support is given to all Americans who have paid into the system or are eligible for coverage.

W-2 Box 7

This reflects any tips or commissions that you have declared to your employer.

The total of this box, when added to Box 3, should not equal more than $97,500. If you have not reported tips or additional income to your employer, then this box will appear blank or have a zero amount.

W-2 Box 8

This box is used by food and beverage establishments to indicate the tips allocated to the employee.

Businesses in the food industry whose employees receive tips must make sure that the tips meet certain requirements and compensate their employees for the difference if they do not. Tip allocation means that the employee’s tips must be at least 8 percent of the businesses’ gross receipts during the payroll period, and Box 8 makes certain that the employee tips meet these requirements.

W-2 Box 9

This is the total amount paid to you by your employer as an advance payment on the Earned Income Tax Credit (EITC).

The EITC is an advance on the Earned Income Credit available to low and moderate-income taxpayers. This advance is used by the employer to lower the employee’s withholding amounts for each pay period. This lowers the ongoing tax burden on the individual rather than making them wait to receive a refund. This option has been eliminated as of January 1, 2011.

W-2 Box 10

This reflects any deductions from your wages for childcare or other dependant care.

This section shows the total dependant benefits paid for by an employer for their employee through a care assistance benefit program. This may include benefits provided in-kind by the employer or an amount paid directly to a daycare facility, or reimbursements to the employee for said care.

W-2 Box 11

This indicates any distributions you have received from a nonqualified retirement plan or a non-governmental section 457(b) plan.

Individual contributions to a non-qualified retirement plan are generally not subject to taxes during the calendar year the earnings occur but are subject to taxes when withdrawn from the plan. These plans do not include contributions by the employer, although the employer does maintain the responsibility of deferring paycheck contributions to a fund established by the employee. As a result, any distributions received by an employee are reported to the employer for inclusion on the W-2.

W-2 Box 12

This contains an amount and a letter code. This area is used to report various benefits and forms of compensation not captured in boxes 1-11.

This section will contain an amount and a letter code from A thru Z, AA, and BB. The key to these codes can be found on the back of the W-2 and includes such contributions as employer-paid adoption benefits, employer contributions to a health savings account, nontaxable combat pay, and nontaxable reimbursements for employee moving expenses, to name a few. Consult the back of the W-2 for a full list of descriptions.

W-2 Box 13

This section contains 3 checkboxes to indicate whether you are a statutory employee, received third-party sick pay, or participated in the employer’s retirement plan.

A statutory employee is a full-time employee that does not pay income tax, although they pay Social Security and Medicare tax. Salespeople, agents, home-based workers, and drivers can file as self-employed to deduct business expenses such as travel, entertainment, vehicle, etc. directly instead of itemizing them on Schedule A. Third-party sick pay is compensation that an employee receives while not working due to illness from an insurance company that is under the employers’ insurance plan. If an employee participates in an employer’s retirement plan, this box is checked.

Third-party sick pay is compensation that an employee receives while not working due to illness from an insurance company under the employers’ insurance plan.

If an employee participates in an employer’s retirement plan, this box is checked.

W-2 Box 14

This section indicates additional deductions that are not covered elsewhere on the W-2.

This section often includes information such as union dues, tuition assistance, health-related insurance premiums, and after-tax contributions to retirement plans. Most of these entries are considered nontaxable earned income.

W-2 Box 15

The employer’s State Tax Identification number is listed here.

W-2 Box 16

This section lists total wages for the year that are subject to the state income tax. This amount may or may not reflect the same amount as Box 1.

W-2 Box 17

The state income tax amount has been withheld.

In some states, the income tax rate will change according to income and in some states, it is simply a flat rate.

W-2 Box 18

The total amount of income that qualifies for local taxation. Some localities do not require this information, so this box can be empty even if Box 16 has a value.

W-2 Box 19

The amount of local tax (if applicable) that is withheld from wages.

Many states require individuals to pay school district, county, and municipal taxes.

W-2 Box 20

The code or name of the locality corresponds to the income and taxation reported in boxes 18 and 19.