Walmart W2 Forms for Employees –

The deadline for sending the (via U.S. mail) 2025 W-2 forms is January 31st, 2025. You should deliver the form at least a few days before this date. If not, then you must call your HR department. You must still submit your tax returns regardless of whether or not you have received these or not. Numerous websites, such as TurboTax, typically have the data and calculate the tax amounts.

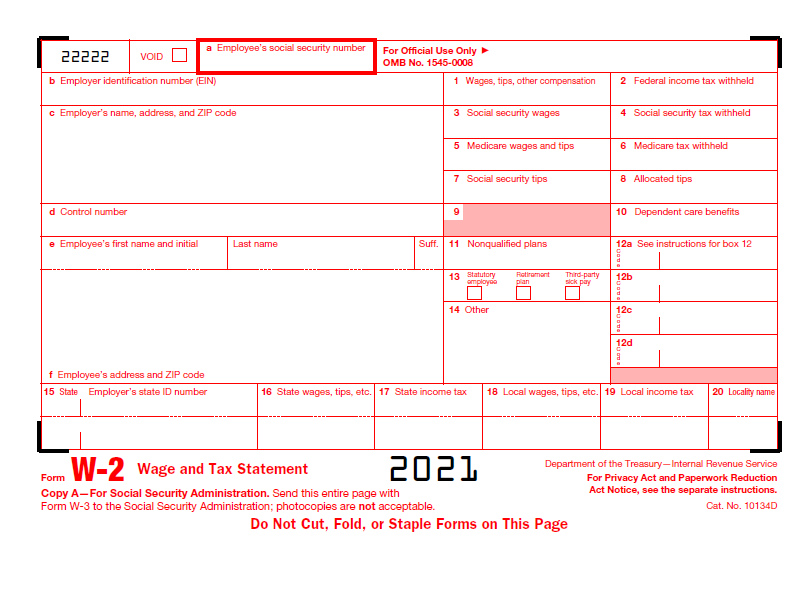

A W-2 Form is one of the forms that an employer must give to the employee and the Internal Revenue Service after each year. The form will reveal the employee’s total earnings, including social security income, Medicare earnings, and the amount of tax withheld from their pay. If you’re an employee at Walmart, you will be issued a Walmart employee. The Employer Identification Number will be issued and recognized by Walmart.

Does Walmart Mail Out W-2s ?

For employees to expedite the process of filling out a W-2 form, W-2 paperwork can be downloaded from the secure OneWalmart site. If you forget your login credentials, you can access Walmart portals with your username and password.

Please contact Walmart Field Support at (479) 273-4357 if you are having problems logging in.

When do Walmart employees receive their W-2s?

Under federal law, Walmart must deliver W-2 forms to all employees between January 31 and February 28 to file their tax returns on time. This means they will provide employees with their W-2 documents on time.

To ensure there are no overpaid or unpaid taxes, employers must prepare W-2 forms for former and current employees, and filing taxes late can result in penalties.

How to get Walmart W2 Forms for Employees?

You’ll be required to sign in to the WalmartOne website using their associate account. If you do not have an associate account, you’ll have to sign in with an account with your Walmart Identification Number, the birth date of birth, hire date, and your email. Once you’re signed in, you’ll be able to navigate to “My Money,” which provides your salary, financial benefits, and tax details. You can click “find my W-2,” which will appear under the section titled “W-2 Management. You can look up, download, and print your W-2 Forms there. Assume you need a form W-2 unavailable in the section titled W-2 Management on the WalmartOne accounts. In that case, you’ll have to contact human resources or the payroll department.

You don’t need to complete the W-2 form independently if you’re an employee. Employers will supply all the information required in the state and the code for import. Following that, you’ll receive a tax statement in April. You can view your tax withholdings and their impact on your payments on that tax invoice.

How to get Walmart W-2 Form if you no longer work for Walmart?

Your W-2 form will be sent to your address when you have left Walmart. However, if you’ve moved to another location, you should contact the HR office to change your address. Walmart has a method to mail its online W-2 form to employees currently employed who prefer to receive the form electronically.

Alternatively, you can get the W2 Form from this link IRS W2 Form.