W-2 Employee Information – If the January 31st deadline has passed and you are still waiting for your W-2 from your employer in late February, there are several steps you can take to get either your W-2 or file your taxes without it.

Step 1

Your first step is to check with payroll. Placing a phone call or sending an email to your payroll administrator to ensure that they have your correct mailing address and determine when it was mailed (and from where your employer uses a remote payroll company) will give you a better sense of when to expect the document. If the company indicates that they have sent it and it has not reached you within a reasonable amount of time, ask them to send you a replacement.

Step 2

If you still do not receive the W-2 in the mail despite these efforts, you must contact the IRS to let them know that your employer has neglected to provide you with the form (1-800-829-1040). Before you call, find your last pay stub and locate your company’s Employee Identification Number (EIN). If this number is not on your pay stub, check the previous year’s W-2 if you received one from the company. This number is not essential, but it will help the IRS locate your information and expedite the reminder notice the IRS will send to your employer, requesting that they send you your W-2. When the IRS sends this notice to your employer, they will also send you form 4852, which will substitute for your W-2 in the event that your employer does not send it in time for the tax deadline.

Step 3

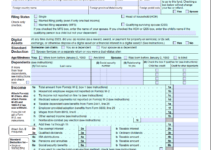

You must file your taxes or request an extension by April 18, 2024. If you have not received your W-2 by the due date after completing the above steps, you can file using form 4852. Using your last pay stub, which will have year-to-date amounts of Social Security and state and local taxes withheld, your total wages, pension, and 401 K contributions, you can estimate your refund or the amount you owe. Form 4852 is attached to your tax return, just as you would attach a W-2 form. If you receive multiple W-2s, you will submit these along with form 4852 from your delinquent employer. Instructions for filing form 4852 are available on the IRS website.

Step 4

If you receive your W-2 after you have filed your taxes using form 4852 and you discover that the amounts are different from your estimates, this changes the amount you are due or that you owe, you must file Form 1040X amending your tax return. Forms and instructions are available on the IRS website.

Ultimately, filing your income taxes is your responsibility regardless of the degree of irresponsibility an employer or former employer displays in the delivery of your W-2 form. Diligence and clear communication with the IRS is necessary to ensure that you do not pay stiff penalties.