Category: State Payroll

On March 2, 2016, Gov. Brown authorized a regulation giving for increases to Oregon’s minimum base salary. The minimum wage increases began on July 1, 2016, and provide for …

Maryland’s currently has a minimum salary of $11.00, other than in Prince George’s and Montgomery areas. In Prince George’s Area, the base salary is at $11.50. Starting later on …

Louisiana does not developed a regulation for a state minimum wage rate. Louisiana regulation forbids any governmental subclass of the state from developing a base pay for workers LA …

KY labor laws about breaks define that staff members need to be provided a minimum of a 10 minute break for every 4 hours of work. Both federal and …

Companies in Kansas need to pay a base pay of a minimum of $7.25 per hour. Staff members protected under the Fair Labor Standards Act need to get the …

Iowa has a mutual withholding commitment with Illinois that permits earnings tax withholding for the staff member’s state of residence just. Iowa’s existing base pay is $7.25 and Iowa …

Indiana citizens, consisting of full-time, part-time, momentary or seasonal employees, undergo keeping on all earnings made, regardless of where the service was carried out. Indiana companies should likewise abide …

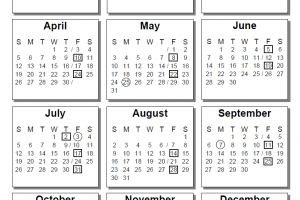

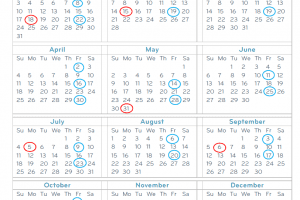

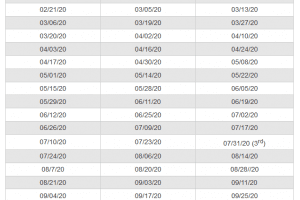

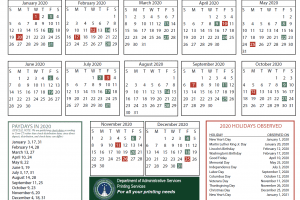

State of Idaho Payroll Calendar – Payment needs to be at least once a month. Standard pay periods should be assigned ahead of time by the company, and payment …

Florida law demands employers to provide their employee a detailed paycheck that will show all of their salary earned in that pay time period, income taxes deducted, and other …

Connecticut acknowledges civil unions and offers tax advantages for celebrations to these unions that are not readily available under federal tax regulation. Connecticut companies need to pay their staff …