Companies in Kansas need to pay a base pay of a minimum of $7.25 per hour. Staff members protected under the Fair Labor Standards Act need to get the federal base pay of $7.25 per hour. Kansas tips might be credited for 40 per cent of the base pay for staff members usually maintaining and getting a minimum of $20 each month in tips.

Under Kansas regulation, companies need to pay staff members at a rate of one and half the staff member’s routine per hour salary for working greater than 46 hours in one week. Under federal policy, overtime schedules after 40 hours in one full week. That regulation uses depends upon a company’s quantity of yearly earnings and interstate commerce. The right to overtime pay can not be waived by the worker.

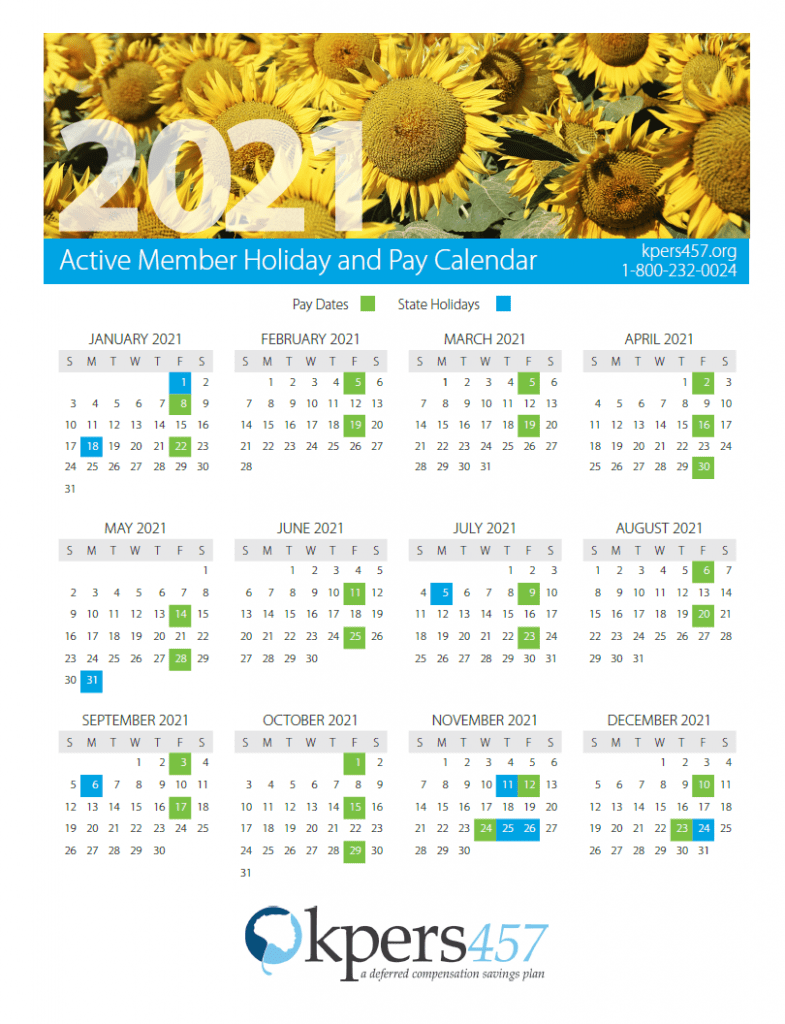

Companies protected by Kansas’ wage payment policy need to pay earnings a minimum of once calendar month and not greater than 15 days following the close of a pay period. Kansas needs companies to keep state earnings tax from workers’ earnings and remit the quantities kept to the Department of Revenue.

Companies need to keep tax from all taxable salaries paid to resident staff members carrying out services in or out of Kansas and to nonresident workers carrying out services inside the state.

State of Kansas Payroll 2025

State of Kansas Payroll .