Author: dave

US Department of Labor Payroll 2025 – The payroll department keeps track of all payroll data for an organization. This includes employee payroll stubs, W-2 statements, tax forms, deposits, and …

DOD Payroll Calendar 2025 – The Department of Defense (DoD) involves directly with the tasks and the United States Force. The DoD provides the military workers, arms, and civilian …

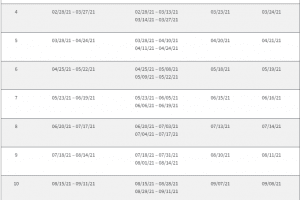

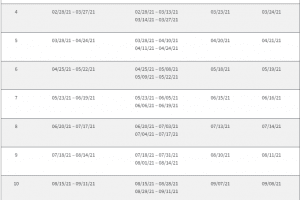

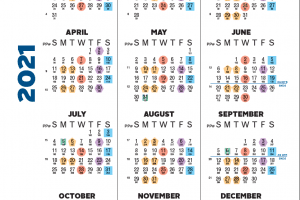

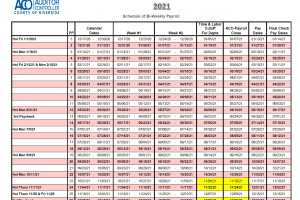

County of Alameda Payroll Calendar – In California, workers are made eligible to numerous legal rights, including overtime rest, meal and pay breaks, holiday vacation pay, base pay, and …

County of Sacramento Payroll Calendar – Right now, minimum living wage for the State of California’s is set to $13.00/hour, same minimum wage apply in Sacramento County as this …

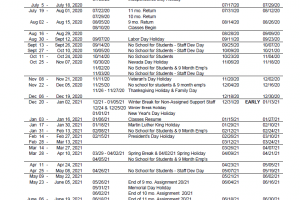

Clark County School District CCSD Payroll Calendar 2025 – The Clark County School District is a school district that works in all of Clark County, Nevada, consisting of Las …

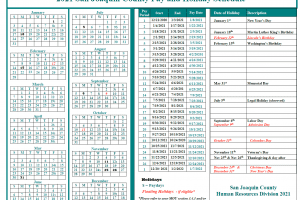

County of San Joaquin Payroll Calendar – Currently, California’s state living wage rate is $13.00 per hour, County of San Joaquin apply the same minimum wage as CA state …

Henrico county is in Virginia; therefore, the payroll regulation falls under the regulation of Virgina State. Employer in Virginia are asked to pay their employee at least once a …

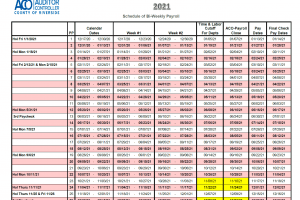

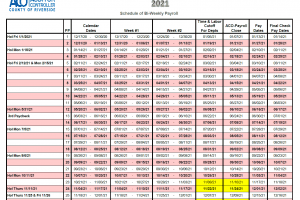

Number of workers at Riverside County in 2018 was 20096. The average yearly income was $70,625; also, the median wage was $60,782. County Of Riverside average earnings is 51 …

Wyoming’s existing base pay is $5.15. Likewise, Wyoming companies should adhere to federal base pay regulations, which presently sets the federal base pay at $7.25. as well as commissioned …

Wisconsin has mutual withholding agreements with Illinois, Indiana, Kentucky, and Michigan to exclude Wisconsin locals working in those regions from earnings tax obligation and tax filing obligations in those …