County of Alameda Payroll Calendar – In California, workers are made eligible to numerous legal rights, including overtime rest, meal and pay breaks, holiday vacation pay, base pay, and other advantages. Base pay policies administer to San Francisco, Los Angeles, and all other cities in the state of California. The base pay applies to all part-time and full-time staff members in all industries, from building to foodservice and hospitality to advertising.

If an employer pays base pay to their staff members, the employer needs to pay them with base pay policies, whether it be federal or the state where they are getting a greater income. In lots of circumstances in California, the California base pay will normally apply as this is the higher rate for employees.

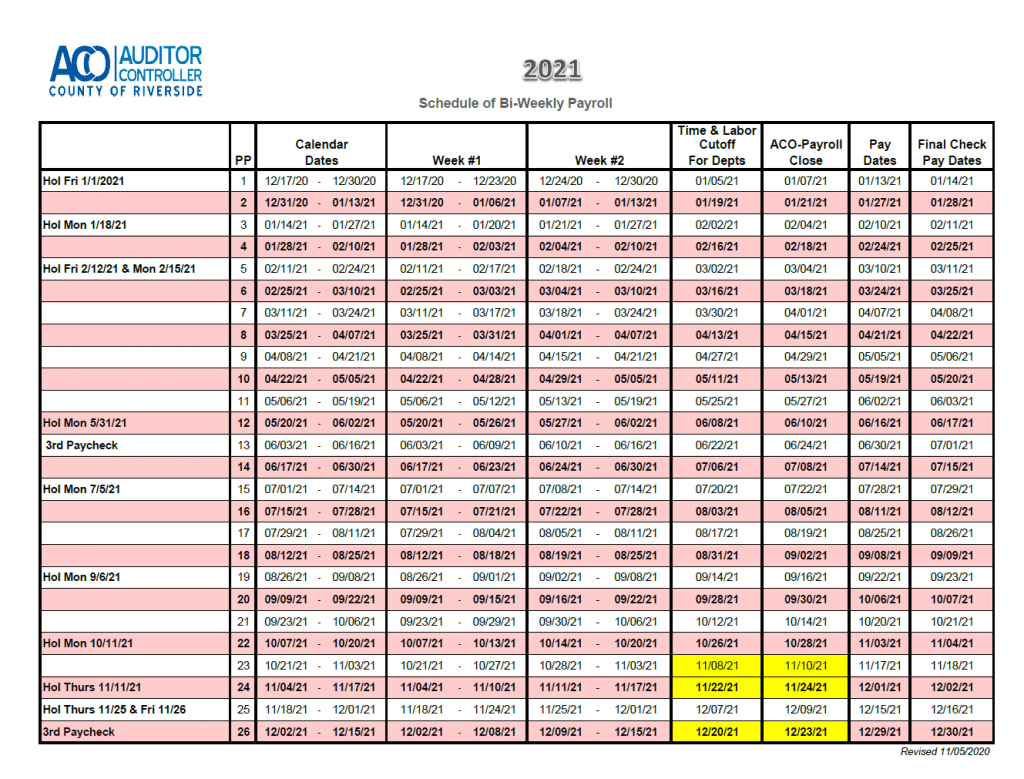

Companies should pay their employees regular incomes, with a couple of small exceptions, at least two times throughout the calendar month on specific days controlled as paydays. It is the employer’s duty to develop a standard pay routine and notice posted as to the day, time, and place of the payment. CA Labor Code Section 207

Employers are required to overtime earnings just after the next payroll following the period in which the overtime incomes had been made. Companies will require to comply with the CA Labor Code Section 226( a). All overtime worked by an employee has been tape-recorded properly in an itemized statement for the next available pay date and will consist of dates of the pay period in which the correction has been made.

California Income Tax Withholding

California’s State policies require that all companies hold out a state individual income tax from all worker incomes and remit them to the Employment Development Department.

Independent contractors who work for themselves are not subjected to a particular withholding.

There are no reciprocal taxation arrangements in California. Homeowners in Virginia, Oregon, Indiana, Guam, and Arizona are provided a credit toward their California income tax liability from any taxes that have been paid toward their home state.