Employers must mail out the W-2 forms to each employee or provide 1099 forms to each contract employee by January 31st.

- This means that they must be postmarked by this date, not that employees must receive them by this date.

- All employees should anticipate the forms sometime after the January 31st mailing deadline.

- The W-2 form will indicate the total amount earned by the employee and the total amount withheld for federal, state and local taxes during the previous year.

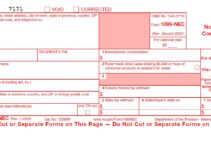

- The 1099 form will indicate the total compensation that a contracted employee has been paid during the previous year.

- Incidentally, the January 31st date is also the deadline for self-employed individuals to file and pay their 4th quarter estimated tax payment to avoid incurring a penalty.

Employers are required to submit the W-2 form to any employee who has had income withheld through their employer for social security, Medicare and state and federal taxes or who has not filed an exemption from the withholding of taxes on their W4 form.

- The W4 form is the withholding allowance documentation that an employee fills out when hired by a company to indicate how much of their pay should be withheld to fulfill their taxation responsibility to the state and federal government.

- Employees that receive a 1099 form do not fill out a W4 form for their employer; instead, they have completed a W9 form that does not include withholding taxes based on the number of dependents. The W9 form includes only a social security number and tax identification number. Employers are required to submit 1099 forms to employees by January 31st.

Additional Information:

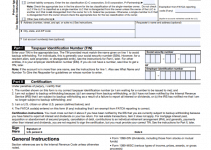

- Companies are required to submit the W-2 and 1099 forms to the Social Security Administration by either February 28th or 29th, depending on the presence of a leap year, for all income earned during the previous tax year. However, filing electronically extends the deadline until March 31st.

- Failure to do so results in a variety of penalties based on the length of delinquency in filing and the ability to provide adequate explanation and documentation for the delay. The cost of the penalties ranges from $30 per W-2 form if it is filed within 30 days to a maximum penalty of $500,000 per year ($200,000 for small businesses).