Pennsylvania’s current minimum wage is $7.25. Pennsylvania sets its base pay to be like the federal minimum wage. Therefore, assuming that the federal minimum wage adjustments, Pennsylvania’s will alter to that very same rate. Pennsylvania has mutual withholding contracts with Indiana, Maryland, New Jersey, Ohio, Virginia, and West Virginia.

All employees covered other than those particularly exempt by statute; those exempt are farm laborers (besides seasonal farmworkers). Executive, administrative, expert, and outside sales workers are likewise exempt, considered that specific requirement meets.

Companies covered by Pennsylvania’s wage payment regulation should pay a salary within 15 days of completing a pay period. Overtime salaries are payable in the next pay period unless written terms or custom in the trade are given otherwise.

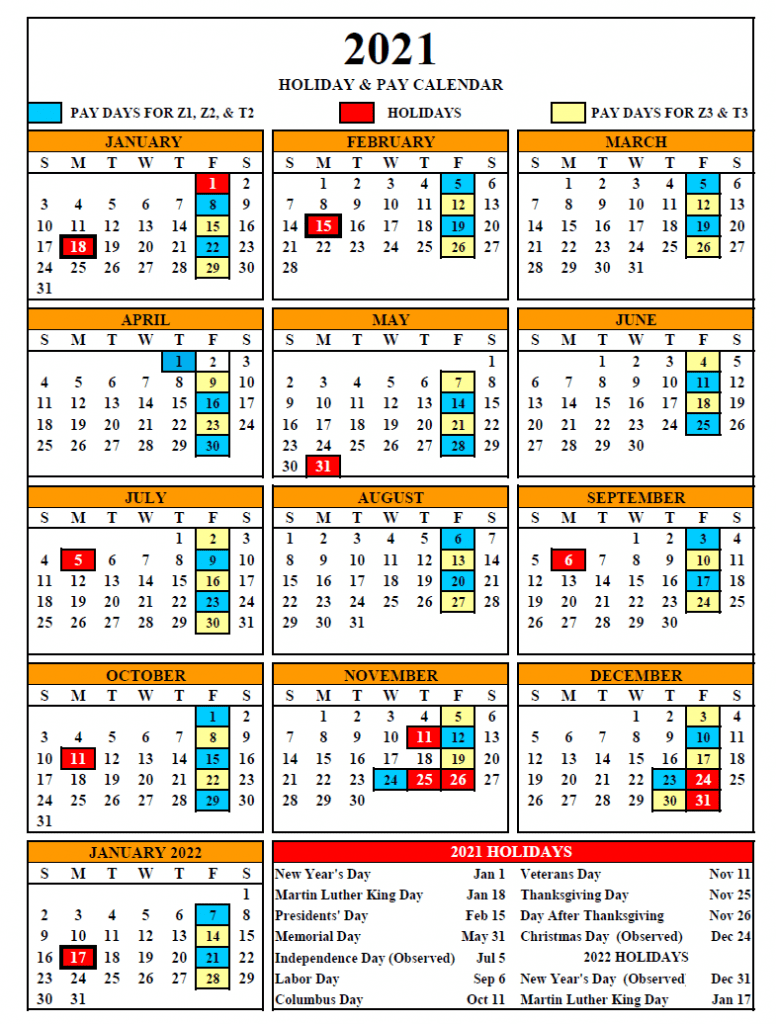

Except otherwise specified in an agreement of employing, a company needs to pay staff members not paid by a yearly wage a minimum of semi-monthly. Assuming that a company pays salaries semi-monthly, the very first payment should be made between the very first and fifteenth day of every month. The 2nd payment should be made between the fifteenth and the last day of the month.

A company should pay all salary due to his workers on routine paydays . Overtime earnings might be considered as salary and payable in the next prospering pay schedule. All salary made in any pay period need to be be paid.