State of New York Payroll 2025 – New York’s existing minimum wage differs depending upon its size and the area where the staff members work. In addition, in New York companies with more than one staff on a minimum of thirty days in the fiscal year have to provide disability insurance coverage for workers. Companies covered by New York’s wage payment regulation should pay manual staff a minimum of once a week and all other salaried teams two times a month.

All staff members are protected, other than those particularly not subject to statute; amongst those excluded are executive, expert, or administrative staff members making more than $900 a week.

New York labor regulations need a company to pay extra time to staff members, except if otherwise not subject, at the rate of 1 1/2 times the worker’s standard rate of spend for all hours operated over 40 hours in a workweek.

New York labor legislations need specific companies to offer their workers a minimum of 24 consecutive hours rests in any calendar week. Companies covered by this regulation consist of those running factories, mercantile hotels, dining establishments, and facilities. Other companies are covered.

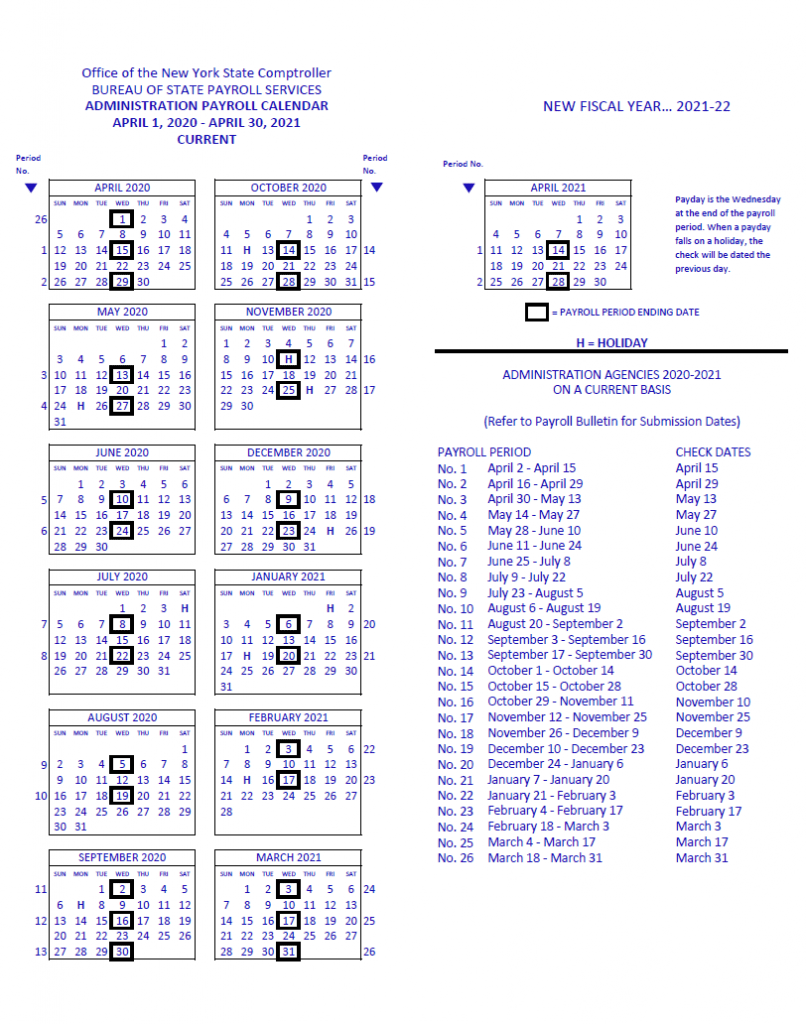

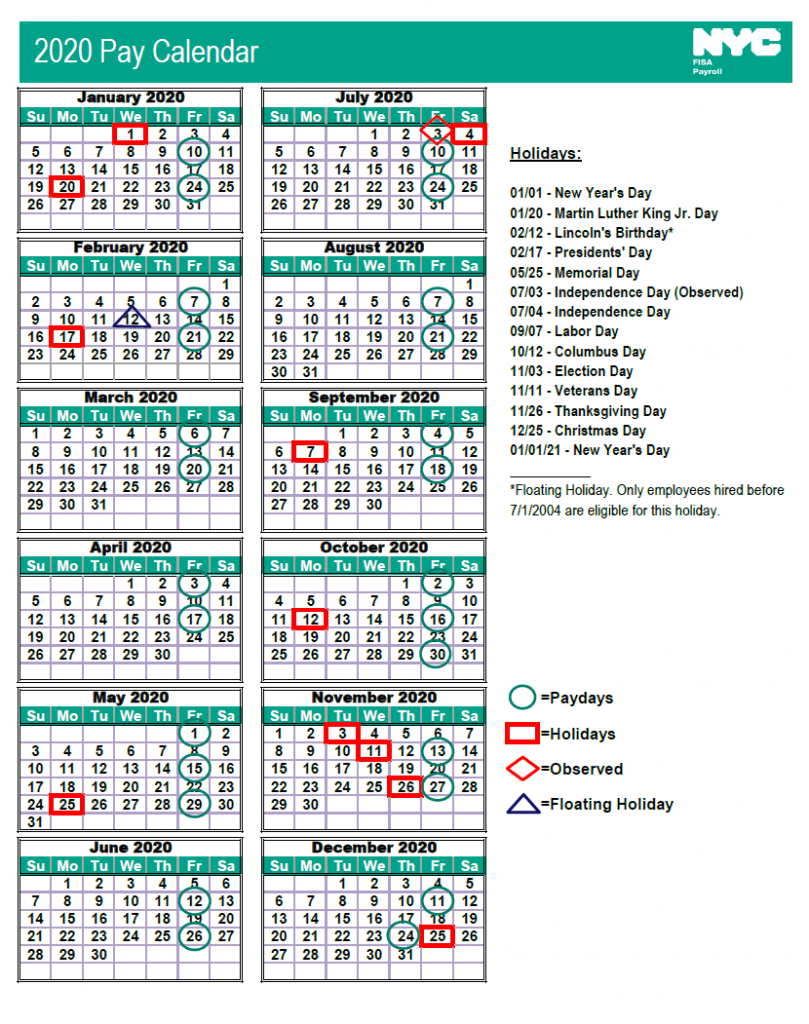

Download State of New York Payroll 2025

State of New York Payroll2025 Holiday and Pay Calendar