KY labor laws about breaks define that staff members need to be provided a minimum of a 10 minute break for every 4 hours of work. Both federal and Kentucky labor laws about breaks need that these brief rest breaks be paid, if they are less than 20 minutes long

Employee covered by Kentucky’s base pay law should be paid $7.25 an hour. If the federal base pay boosts, the state base pay will increase by the exact same quantity. Out-of-state companies might willingly keep Kentucky tax from the incomes paid to a Kentucky homeowner who is working beyond Kentucky.

Kentucky Payroll for Employers.

Companies covered by Kentucky’s wage payment law should pay salaries a minimum of semimonthly and not more than 18 days after the incomes were made. Workers missing on payday should be paid within 6 days after they require payment.

Kentucky Earnings Tax Withholding.

Kentucky’s law needs companies to keep state earnings tax from workers’ salaries and remit the quantities kept to the Department of Earnings.

Any company needed to keep federal earnings taxes is likewise needed to keep Kentucky earnings taxes, consisting of farming companies. Specific business officers and officers of minimal liability business are held personally responsible for taxes that are needed to be kept from earnings paid to staff members of the corporation.

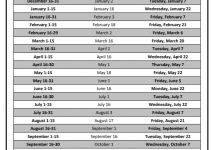

State of Kentucky Payroll Calendar 2025

[su_button url=”https://personnel.ky.gov/DHRA/SalarySchedule.pdf

” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll “] Kentucky State Payroll [/su_button]