Ohio State Payroll Calendar 2025 – Employers who make more than $323,000 per year in gross receipts are eligible for $8.80 minimum wage. Employers earning less than $323,000 annually in gross receipts must pay their employees the Fair Labor Standards Act’s minimum wage of $7.25. Ohio Minimum Wage Poster

Ohio’s constitution mandates an annual review of the minimum wage. The cost of living must be adjusted to increase the minimum wage by the amount. The cost of living changes are based on the consumer index or its successor index, which is calculated by the federal government and round to the nearest five-cents. Any changes to the minimum wage take effect January 1, the year following.

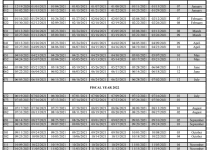

Ohio State Payroll Calendar 2025

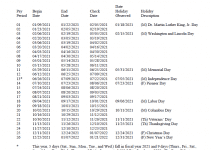

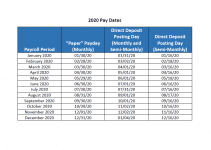

Employers must pay their employees at least twice a month (semi monthly). Employers must pay employees at least twice per month ( biweekly payroll ). An employee who is absent from work and is not receiving his wages at the time of payment shall be entitled to that payment upon demand at the location where such wages are paid.

Employers may extend the time that is customary for a trade, profession, or occupation. Or, they may establish a different time lapse through written contract or operation of law.

All Credit Union of Ohio Members will receive a pocket calendar in their statements. If you are not a member of the credit union, you can request a calendar from your payroll department (as long as they have made a supply request from us).

Download Ohio State Payroll Calendar 2025

[su_button url=”https://www.cuofohio.org/content/documents/web-version-2021.pdf” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] 2025 Ohio State Payroll Calendar[/su_button]