Category: State Payroll

State of Colorado Payroll Calendar 2025 – Colorado residents that employ in a different state are excuse from paying for state salary tax? These outside sales reps don’t need to …

California has a regulation governed by the Franchise Tax Panel to keep state tax on settlements made to non-resident independent professionals. California is among 5 states with demanded, worker-funded …

Download State of Alaska Payroll Calendar for 2025. Alaska don’t have state taxes kept from their incomes? That gratuities and pointers might not be credited towards Alaska’s base pay. …

State of Alabama Payroll Calendar 2025 – Employees in Alabama must declare the state A-4 form instead of the federal government W-2. Companies can get a tax credit for …

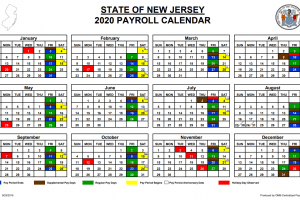

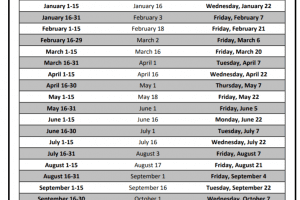

The State of NJ Payroll Calendar 2025 will enable the worker to know all about their pay cycle from the starting date to the end date. It will also …

Arkansas’ minimum wage is $10.00. Starting on January 1, 2025, the base pay will grow to $11.00. Arkansas’ base pay requirement uses just for companies with four or more …

State of Georgia Payroll Calendar – Most state and local governments have implemented payroll system that includes a state pay period calendar. The purpose of the state pay period …

New Jersey’s existing base pay is $11.00 for companies with 6 or more staff members (other than periodic and farming workers) and $10.30 for companies with 5 or less …

How Often Do State Of Arizona Employees Get Paid ? And What Is Payroll Calendar 2025 In Arizona’s State ? Twice a month Law in Arizona requires employees to …

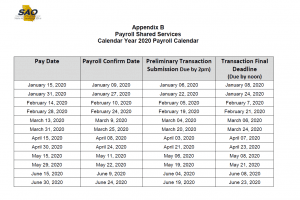

The Fresno State Payroll calendar is a legal document used to keep track of employees and wages, payment dates, personnel reports, tax obligations, bonuses, special deductions, employee change notices, …