Author: dave

Indiana citizens, consisting of full-time, part-time, momentary or seasonal employees, undergo keeping on all earnings made, regardless of where the service was carried out. Indiana companies should likewise abide …

State of Idaho Payroll Calendar – Payment needs to be at least once a month. Standard pay periods should be assigned ahead of time by the company, and payment …

Florida law demands employers to provide their employee a detailed paycheck that will show all of their salary earned in that pay time period, income taxes deducted, and other …

Connecticut acknowledges civil unions and offers tax advantages for celebrations to these unions that are not readily available under federal tax regulation. Connecticut companies need to pay their staff …

State of Colorado Payroll Calendar 2025 – Colorado residents that employ in a different state are excuse from paying for state salary tax? These outside sales reps don’t need to …

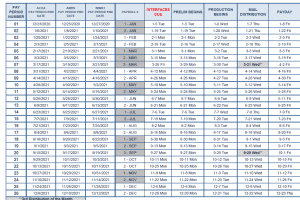

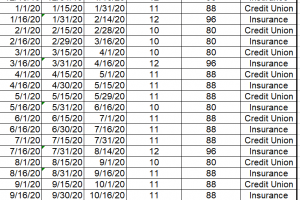

The payroll is a tool that focuses to provide a straightforward channel of income payment to the staff members of an organization. Practically, a payroll is comprised of a …

One of the best benefits that you can get out of your Payroll Calendar is that it helps you maintain your records perfectly and on time. It also helps …

California has a regulation governed by the Franchise Tax Panel to keep state tax on settlements made to non-resident independent professionals. California is among 5 states with demanded, worker-funded …

Download State of Alaska Payroll Calendar for 2025. Alaska don’t have state taxes kept from their incomes? That gratuities and pointers might not be credited towards Alaska’s base pay. …

State of Alabama Payroll Calendar 2025 – Employees in Alabama must declare the state A-4 form instead of the federal government W-2. Companies can get a tax credit for …