Wisconsin has mutual withholding agreements with Illinois, Indiana, Kentucky, and Michigan to exclude Wisconsin locals working in those regions from earnings tax obligation and tax filing obligations in those states? That citizens of the reciprocating states have the very same exceptions on settlement made in Wisconsin.

Wisconsin’s current base pay is $7.25. Wisconsin companies should also abide by federal base pay regulations, which presently sets the federal base pay at $7.25.

If a company picks to pay their employee on minimum wage, the company should pay those staff under the base pay policy, either federal or state, which leads to the staff members being paid the higher salary.

Wisconsin Payroll for Employers

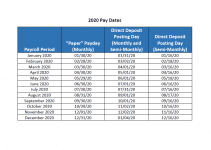

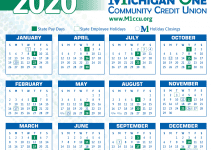

Within Wisconsin’s wage payment regulation, companies need to pay earnings a minimum of month-to-month and not beyond 31 days following a pay period’s close. A company can pay employees under legitimate collective bargaining arrangements on various payment schedules.

Wisconsin Income Tax Withholding

Wisconsin needs companies to keep state individual earnings tax (PIT) from their staff members’ earnings and remit the quantities kept to the Department of Revenue.

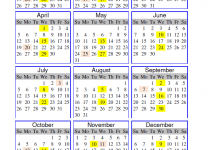

State of Wisconsin Payroll Calendar 2025

[su_button url=”https://dpm.wi.gov/Documents/CAL21.pdf

” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Wisconsin Payroll Calendar 2025 [/su_button]