Virginia’s current base pay is $7.25. Virginia has embraced the federal base pay stated by the Fair Labor Standards Act as its base pay. VA Statute 40.1-28.10. Virginia minimum wage regulations exempt all workers entitled to minimum wage under the Fair Labor Standards Act.

Because many Virginia employees are subject to the Fair Labor Standards Act, Virginia’s base pay rule arrangements do not employ many staff members operating in Virginia. VA Statute 40.1-28.9( B)( 12 ). Furthermore, Virginia base pay regulations do not apply to companies with less than four staff one time. Given that the company’s partner, kids, and parents are not included in determining the number of people employed.

State of Virginia Payroll Law

All companies should develop a regular pay period schedule. For hourly staff, the payment of their salary should be made on a biweekly basis. Meanwhile, Salary staff have to be pay once a month.

Workers who might also be paid monthly are trainees registered in a work-study program or its comparable, and staff members whose weekly earnings surpass 150% of the state’s average weekly rate.

Companies in Virginia are exempt from withholding requirements for individual nonresident staff who live in Columbia District, Maryland, Kentucky, Pennsylvania, and West Virginia. They commute daily to operate in Virginia and get incomes for services carried out in Virginia for a company within Virginia’s geographical limitations.

Virginia Income Tax Withholding

Virginia regulation obliges companies to withhold state earnings tax from their workers’ wages plus pay the amounts kept to the Department of Taxation.

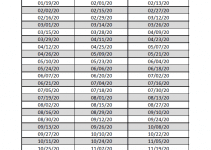

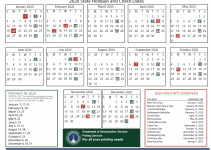

State of Virginia Payroll Calendar 2025

[su_button url=”https://www.dhrm.virginia.gov/docs/default-source/default-document-library/payandholidaycalendar20202021.pdf?sfvrsn=cda8cabb_6″ style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Virginia Payroll Calendar 2025 [/su_button]