North Carolina’s existing base pay is $7.25. North Carolina’s Wage and also Hour Act excuses lots of workers covered by the federal Fair Labor Standards Act from its base pay, overtime, youth work, and recording maintaining guidelines, particularly those staff members who work for business taken part in commerce or in the production of items for commerce as specified in the Fair Labor Standards Act.

North Carolina Payroll for Employers.

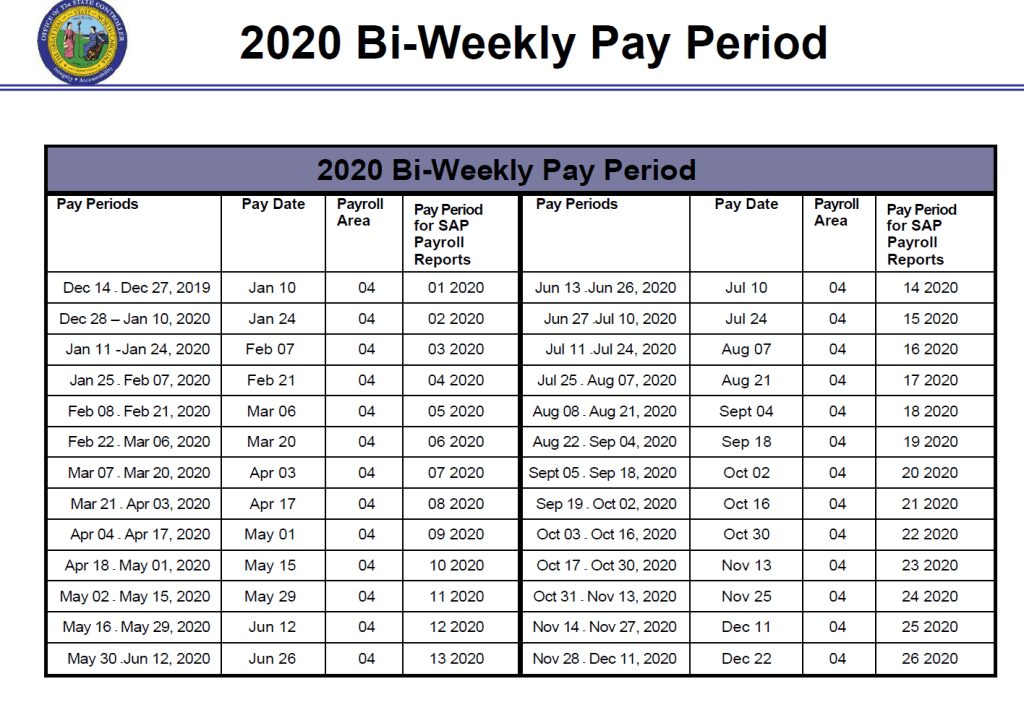

Companies covered by North Carolina’s wage payment policy need to pay incomes on a routine payday. Payroll Calendar durations can be daily, weekly, biweekly, semimonthly, or monthly. Incomes based upon benefits or commissions can be paid as occasionally as yearly in case the itinerary is recommended ahead of time.

North Carolina Earnings Tax Withholding.

North Carolina needs companies to keep state earnings tax from staff members’ earnings and remit the quantities kept to the Department of Profits.

Any company which operates or has a worker in North Carolina, whether the company is a state citizen or not, need to keep state tax. To prevent double tax for locals, North Carolina withholding is not needed in the case that the company is needed to keep taxes from those salaries for the other state or jurisdiction.

State of North Carolina Payroll Calendar 2025

NState of North Carolina Payroll Calendar 2025