Current minimum wage in Massachusetts (Mass) is $12.75.

Massachusetts law in term of minimum wage mandate that the state’s base pay stays a minimum of fifty (50) cents more than the federal government minimum wage stated in the Fair Labor Criteria. Massachusetts companies also must adhere to federal government base pay mandates, which presently sets the federal government base pay at $12.75.

In case a company picks to pay staff members base pay, the company needs to pay those workers in accordance with the base pay mandate, either federal government or state, that leads to the workers being paid the greater wage. In many circumstances in Massachusetts, the Massachusetts base pay will use as it normally ensures a greater wage rate for staff members than federal government policy.

Massachusetts Payroll for Employers

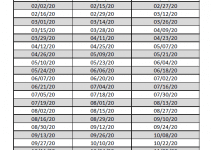

Companies included by Massachusetts’s wage payment policy should pay incomes either weekly or biweekly. Earnings should be paid not more than 6 days following the close of a pay period for workers working 5 or 6 days a week, not more than 7 days after the close of a pay period for staff members working 7 days a week.

Massachusetts Income Tax Withholding.

Massachusetts mandates companies to keep state earnings tax from staff members’ salaries and remit the quantities kept to the Department of Earnings. Companies are demanded to keep under federal government policy are mandated to keep under state regulation.

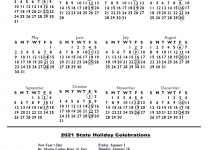

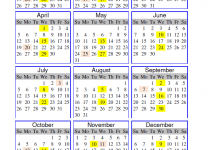

State of Massachusetts Payroll Calendar 2020