Maine labor legislations require companies to compensate workers extra time at a rate of 1 1/2 time their routine rate when they work more than 40 hours in a workweek, unless otherwise exempt. Workers covered by Maine’s base pay legislation should be paid $12.00 an hour.

Maine Payroll for Employers.

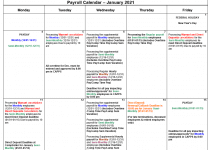

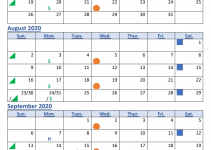

Companies covered by Maine’s income payment regulation should pay salaries at routine periods not to surpass 16 days. Each payment should consist of all earnings made to within 8 days of the payment date.

Maine needs companies to keep earnings tax on all citizens as well as nonresidents with Maine source earnings.

All companies with a workplace or negotiating company within the state as well as paying of taxable incomes to Maine locals or nonresidents should keep state tax. In addition, nonresident companies might keep Maine taxes from the earnings of workers who are Maine citizens as a benefit to those workers.

State of Maine Payroll 2025 & 2025

[su_button url=”https://www.maine.gov/osc/sites/maine.gov.osc/files/inline-files/2020cycle_a_paydates.pdf” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Maine Payroll 2025 [/su_button]

[su_button url=”https://www.maine.gov/osc/sites/maine.gov.osc/files/inline-files/2020cycle_b_paydates.pdf” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] Maine State Payroll 2025 [/su_button]