Louisiana does not developed a regulation for a state minimum wage rate. Louisiana regulation forbids any governmental subclass of the state from developing a base pay for workers LA Statute 23:642. Companies would be needed to pay workers the federal base pay as needed by the Fair Labor Standards Act. Presently, the federal base pay is $7.25.

Generally, Louisiana companies are not needed to pay earnings at any proposed frequency. Companies that stop working to designate particular paydays, nevertheless, should pay earnings on the very first and 16th days of the month or as close to those days as possible.

All workers are covered, other than those particularly exempt by statute; amongst those exempt are specific farming staff members. Companies should keep state earnings tax from staff members’ incomes and remit the quantities kept to the Department of Income.

Companies that pay salaries need to keep taxes from earnings paid to both homeowners and non-residents operating in Louisiana. In addition, nonresident companies are needed to keep earnings taxes from workers who live and operate in the state.

State of Louisiana Payroll Calendar 2025 2025

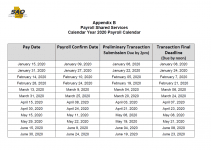

[su_button url=”https://www.doa.la.gov/osup/PayrollCalendars/2021Calendar.PDF” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll “] State of Louisiana Payroll 2025 [/su_button]

[su_button url=”https://www.doa.la.gov/osup/PayrollCalendars/2020Calendar.pdf” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll “] Louisiana State Payroll 2025 [/su_button]

[su_button url=”https://www.doa.la.gov/osup/PayrollCalendars/2020PayPeriod.pdf” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll “] State of Louisiana 2025 Pay Period [/su_button]

[su_button url=”https://www.doa.la.gov/osup/PayrollCalendars/2021PayPeriod.pdf” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll “] Louisiana State 2025 Pay Period [/su_button]