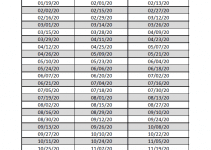

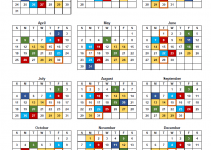

State of Alabama Payroll Calendar 2025 – Employees in Alabama must declare the state A-4 form instead of the federal government W-2. Companies can get a tax credit for giving basic knowledge to their staff members. There is no state-mandated minimum wage regulation in Alabama. The state of Alabama complies with the federal government’s minimum salary of $7.25 per hour, and overtime is not mandated. The Company covered by Alabama’s income payment law required biweekly calendar payment (two times in a month)must pay wages around two times in a calendar month and not beyond 15 days, complying with the close of the pay period.

Alabama Income Tax Withholding

Staff must use the state form A-4 and may not use the federal W-4 as an alternative because Alabama and federal law are different in the number of exceptions granted.

Full-time students who make less than $1,800 per year and who expect to owe no Alabama income tax may file Form A-4E, Staff’s Withholding Exception Certificate. This certificate expires on Dec. 31 of each year. source

Download State of Alabama Payroll Calendar