County of Mariposa Payroll Calendar – The County of Mariposa base pay is the same for all people, despite the number of dependents they might have. Information is upgraded each year, in the very first quarter of the brand-new year State minimum salaries are figured out based upon the published worth of the base pay since January among the coming year. source

County of Mariposa Minimum wage laws follow the same regulation as the California state, The base pay applies to all part-time and full-time workers in all industries, from building to foodservice and hospitality to marketing. The number of employees typically focuses this rate. Nevertheless, a business can provide minimum rates in some scenarios. The state lawmakers have not consisting of overtime payment.

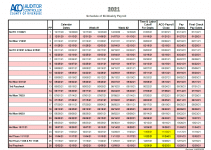

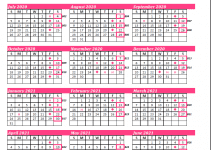

Employers should pay their employees routine incomes, with a couple of minor exceptions, a minimum of biweekly throughout the calendar month on specific days regulated as paydays. It is the company’s duty to develop a routine pay routine and notification posted regarding the day, time, and area of the payment. CA Labor Code Section 207

In case payroll time periods, which is biweekly or semimonthly and the earning period is besides the 1st and 15ht or 16th and the final day of the month, will need to be paid within seven days by the end of the payroll period.

California Income Tax Withholding

California’s State rules require that all companies hold out a state individual income tax from all worker incomes and remit them to the Employment Development Department.

Independent freelance who work for themselves are exempt to a particular withholding. There are no reciprocal tax contracts in California. However, residents in Virginia, Oregon, Indiana, Guam, and also Arizona are provided a credit towards their California income tax liability from any taxes that have been paid towards their house state.

County of Mariposa Payroll Calendar 2025

[su_button url=”https://www.mariposacounty.org/DocumentCenter/View/33796/Salary-Schedule?bidId=” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] County of Mariposa Payroll Calendar 2025 [/su_button]