Category: State Payroll

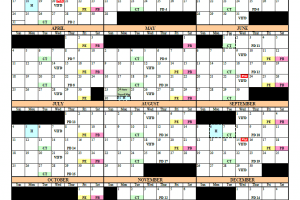

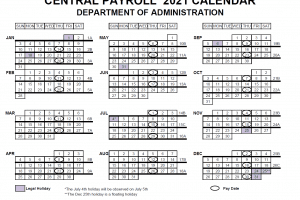

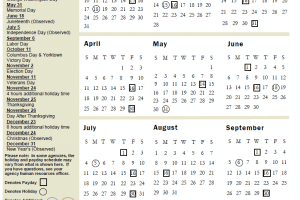

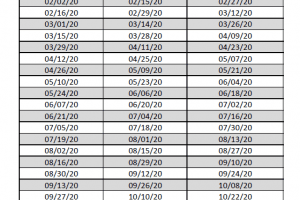

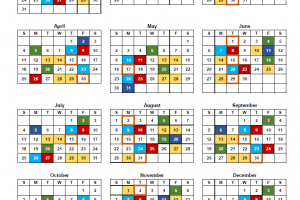

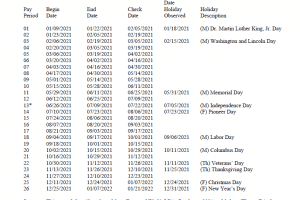

A payroll calendar, which is a financial tool detailing the beginning and end dates of various pay periods, employee pay periods and pay amounts, are a very important resource …

ADOA Payroll Calendar – Companies in Arizona need to abide by federal base pay regulations, which presently sets the federal base pay at $7.25. Starting on January 1, 2025, Arizona’s …

Wyoming’s existing base pay is $5.15. Likewise, Wyoming companies should adhere to federal base pay regulations, which presently sets the federal base pay at $7.25. as well as commissioned …

Wisconsin has mutual withholding agreements with Illinois, Indiana, Kentucky, and Michigan to exclude Wisconsin locals working in those regions from earnings tax obligation and tax filing obligations in those …

Virginia’s current base pay is $7.25. Virginia has embraced the federal base pay stated by the Fair Labor Standards Act as its base pay. VA Statute 40.1-28.10. Virginia minimum …

Vermont’s existing base pay is $10.96. For the year starting January 1, 2019, and every year afterward, Vermont base pay regulations will need a yearly evaluation of its base …

Welcome to Hawaii, The sun’s out, the surf’s up, plus the lifestyle is lavish. That’s precisely why you began a small company in The Aloha State. Whether or not …

Illinois companies should also adhere to federal base pay rules, which presently sets the federal living wage at $7.25. In case a company picks to pay staff members base …

State of Utah Payroll Calendar – Utah’s existing base pay is $7.25. Utah’s base pay for tipped staff members is $2.13. Utah base pay regulations offer the Utah Labor …

State of Tennessee Payroll Calendar 2025 – Tennessee has not yet set up a state minimum salary rate. The minimum wage established in this law would typically apply because most …