Orange County Payroll Calendar 2025 – Wages in California must be paid at least twice a month on the days specified in advance as regular paydays, with a few exceptions (see the table below). The employer must establish regular paydays, and a notification stating the payment date, time, and location must be posted.

Salaries earned between the first and fifteenth days of any calendar month, inclusive, shall be paid not later than the twenty-sixth day of such month, and wages thus earned between the sixteenth and last day of such month shall be paid not later than the tenth day of such month.

All other payroll periods, such as weekly, biweekly (twice a month), or semimonthly (twice a month), must be paid within seven days after the end of the payroll period during which the wages were received.

Suppose the extra hours are documented as a correction on the itemized statement for the next regular pay period and indicate the dates of the pay period for which the repair is being made. In that case, the employer will comply.

If the pay period is not between the 1st and 15th or the 16th and last day of the month, wages earned during such pay periods must be paid within seven calendar days after the end of the pay period. Other pay periods include weekly, bimonthly, and semimonthly.

A company may pay executive, administrative, and professional salaries every month. Once per month on or before the 26th of the month during which the labor was performed. This is if the employer pays the employee’s entire month’s salary, including the unearned portion between the payment date and the last day.

California Income Tax Withholding

California’s policies require that all companies hold out a state individual earnings tax from all worker incomes and remit it to the Employment Development Department. Independent professionals who work for themselves are exempt from a specific withholding.

There are no separate reciprocal taxation agreements in California. Locals in Virginia, Oregon, Indiana, Guam, and Arizona are provided a credit toward their California earnings tax liability from any taxes paid toward their home state.

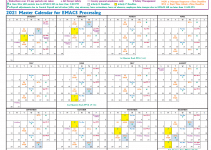

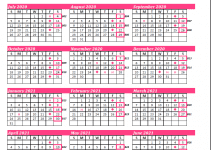

Orange County Payroll Calendar 2025

[su_button url=”https://www.ocgov.com/civicax/filebank/blobdload.aspx?blobid=90585″ style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] Orange County Payroll Calendar 2025 [/su_button]