In easy terms, the quantity of withholding from your income estimates just how much you will owe in taxes at the end of the year based on your salary level and other elements. That number is divided by the number of pay periods you have in one year or, when it comes to per hour workers, by the number of hours you operate in a pay period.

If you will most likely owe the federal government $10,000 and you are paid a weekly wage, $192.30 will be kept from each of your incomes and forwarded to the federal government in your place: $10,000 divided by 52.

| Earnings | Addon | Rate |

|---|---|---|

| $13,000.00 | $0.00 | 10.00% |

| $33,550.00 | $2,055.00 | 12.00% |

| $96,550.00 | $9,615.00 | 22.00% |

| $191,150.00 | $30,427.00 | 24.00% |

| $353,100.00 | $69,295.00 | 32.00% |

| $444,900.00 | $98,671.00 | 35.00% |

| $660,850.00 | $174,253.50 | 37.00% |

| Earnings | Addon | Rate |

|---|---|---|

| $4,350.00 | $0.00 | 10.00% |

| $14,625.00 | $1,027.50 | 12.00% |

| $46,125.00 | $4,807.50 | 22.00% |

| $93,425.00 | $15,213.50 | 24.00% |

| $174,400.00 | $34,647.50 | 32.00% |

| $220,300.00 | $49,335.50 | 35.00% |

| $544,250.00 | $162,718.00 | 37.00% |

| Earnings | Addon | Rate |

|---|---|---|

| $10,800.00 | $0.00 | 10.00% |

| $25,450.00 | $1,465.00 | 12.00% |

| $66,700.00 | $6,415.00 | 22.00% |

| $99,850.00 | $13,708.00 | 24.00% |

| $180,850.00 | $33,148.00 | 32.00% |

| $226,750.00 | $47,836.00 | 35.00% |

| $550,700.00 | $161,218.50 | 37.00% |

Form W-4, Step 2, Checkbox, Withholding Rate Schedules

(Use these if the Form W-4 is from 2025 or later and the box in Step 2 of Form W-4 IS checked)

| Earnings | Addon | Rate |

|---|---|---|

| $12,950.00 | $0.00 | 10.00% |

| $23,225.00 | $1,027.50 | 12.00% |

| $54,725.00 | $4,807.50 | 22.00% |

| $102,025.00 | $15,213.50 | 24.00% |

| $183,000.00 | $34,647.50 | 32.00% |

| $228,900.00 | $49,335.50 | 35.00% |

| $336,875.00 | $87,126.75 | 37.00% |

| Earnings | Addon | Rate |

|---|---|---|

| $6,475.00 | $0.00 | 10.00% |

| $11,613.00 | $513.75 | 12.00% |

| $27,363.00 | $2,403.75 | 22.00% |

| $51,013.00 | $7,606.75 | 24.00% |

| $91,500.00 | $17,323.75 | 32.00% |

| $114,450.00 | $24,667.75 | 35.00% |

| $276,425.00 | $81,359.00 | 37.00% |

| Earnings | Addon | Rate |

|---|---|---|

| $9,700.00 | $0.00 | 10.00% |

| $17,025.00 | $732.50 | 12.00% |

| $37,650.00 | $3,207.50 | 22.00% |

| $54,225.00 | $6,854.00 | 24.00% |

| $94,725.00 | $16,574.00 | 32.00% |

| $117,675.00 | $23,918.00 | 35.00% |

| $279,650.00 | $80,609.25 | 37.00% |

There is a minimal distinction when comparing state and federal withholding taxes. The critical difference is that state withholding is based upon state-level gross income, whereas federal withholding is based upon federal taxable salary. State withholding guidelines are likely to differ amongst the states; meanwhile, federal withholding guidelines correspond all over the United States.

The Internal Revenue Service published the federal withholding tables to help companies determine how much tax to keep from their income. The IRS Publication 15 consists of the tax withholding tables. From 2025 and beyond, the IRS will not publish federal withholding tables Publication 15. Instead, you will require to try to find the Publication 15-T.

The IRS Publication 15-T provides companies with whatever they require to learn about tax withholdings. By looking at the necessary withholding rate timetables, you will understand just how much tax to keep from your workers’ pay.

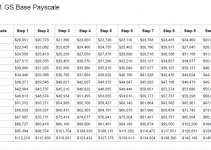

Federal Withholding Table 2025

Check the latest Federal Withholding Table 2025