1040 Form 2025 Printable – The IRS Form 1040 is the primary tax form U.S. taxpayers use to file their annual federal income tax return. It is the platform to report your total income, claim allowable deductions, and calculate your tax liability or potential refund.

Filing Form 1040, the U.S. Individual Income Tax Return, is a critical responsibility for millions of Americans annually. Understanding who needs to file and the timing for doing so can help ensure compliance with federal tax laws and avoid penalties.

What is Form 1040?

Form 1040, officially titled the “U.S. Individual Income Tax Return,” is the standard federal income tax form U.S. taxpayers use to report their annual income to the Internal Revenue Service (IRS). This form helps the IRS calculate the amount of tax you owe or the refund you can expect.

Who Needs to File Form 1040?

Most U.S. citizens and resident aliens who meet specific income thresholds must file Form 1040. The necessity to file depends on several factors, including your gross income, filing status, age, and whether you can be claimed as a dependent on someone else’s return.

Income Thresholds for 2025:

- Single Filers:

- Under 65: $12,950

- 65 or older: $14,700

- Married Filing Jointly:

- Both spouses under 65: $25,900

- One spouse 65 or older: $27,300

- Both spouses 65 or older: $28,700

- Head of Household:

- Under 65: $19,400

- 65 or older: $21,150

- Married Filing Separately: Any age: $5

- Qualifying Widow(er) with Dependent Child:

- Under 65: $25,900

- 65 or older: $27,300

You must file a tax return if your gross income is equal to or greater than the threshold for your filing status and age.

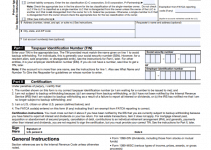

Components of Form 1040

Form 1040 is divided into several sections, each designed to capture different aspects of your financial situation:

- Personal Information: This section requires basic information, such as your name, Social Security number, and filing status (single, married, filing jointly, head of household, etc.).

- Income: Here, you’ll report all forms of income, including wages, salaries, tips, interest, dividends, and any other income sources.

- Adjustments to Income: This part allows you to claim deductions that are not itemized, such as contributions to retirement accounts, student loan interest, and health savings account (HSA) contributions.

- Tax and Credits: In this section, you calculate your taxable income and apply any tax credits you’re eligible for, such as the Child Tax Credit, Earned Income Credit, or education credits.

- Other Taxes: If applicable, this part includes additional taxes such as self-employment and household employment taxes.

- Payments: Here, you report any tax payments you’ve already made throughout the year via withholding or estimated tax payments and any refundable credits.

- Refund or Amount Owed: This section determines whether you owe additional tax or are entitled to a refund.

When to File Form 1040

Standard Filing Deadline:

The standard deadline for filing Form 1040 is April 15th of the year following the tax year in question. For example, the deadline for the 2025 tax year is April 15, 2025. If April 15 falls on a weekend or a legal holiday, the deadline is extended to the next business day.

Extensions:

If you need more time to file, you can request an extension by submitting Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, by the original due date of your return. This extension gives you until October 15th to file your return. However, it’s important to note that an extension to file is not an extension to pay any taxes owed. To avoid penalties and interest, you must estimate and pay any taxes due by the original filing deadline.

Special Circumstances:

Specific individuals may qualify for particular deadlines:

- Military Personnel: If you serve in a combat zone or a qualified hazardous duty area, you may be granted additional filing time.

- Disaster Relief: Victims of certain natural disasters may receive extended filing deadlines as announced by the IRS.

Form 1040 has several supplemental schedules that may be necessary depending on your tax situation:

- Schedule 1: For additional income and adjustments, such as business income or health savings account deductions.

- Schedule 2: For additional taxes, like alternative minimum tax (AMT) or repayment of excess advance premium tax credits.

- Schedule 3: For additional credits and payments, including education or residential energy credits.

Other forms that might be attached include Schedule C for business income, Schedule D for capital gains and losses, and Schedule E for rental income.

Fundamental Changes for the 2025 Tax Year

As tax laws evolve, so do the forms. Here are some notable changes for the 2025 tax year:

- Standard Deduction: The standard deduction amounts have increased slightly to account for inflation.

- Child Tax Credit: Adjustments to the credit amount and eligibility criteria may affect your Filing.

- Retirement Contributions: Increased contribution limits for 401(k) and IRA plans can impact your taxable income.

Tips for a Smooth Filing Process

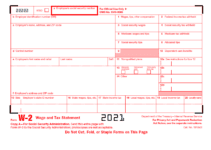

- Gather Documents Early: Start collecting W-2s, 1099s, mortgage interest statements, and other relevant documents early to avoid last-minute stress.

- Double-Check Information: Ensure all personal information is accurate and matches your records.

- Consider e-Filing: Electronic Filing can expedite processing and refunds, reducing the risk of errors.

- Use Tax Software: Programs like TurboTax or H&R Block can simplify the process and help you catch deductions and credits you might otherwise miss.

- Consult a Professional: If your tax situation is complex, consulting with a CPA or tax advisor can provide peace of mind and save you money.

It’s important to remember that tax laws can be complex and can change from year to year. For the most up-to-date information, it’s always best to refer to the official IRS website at https://www.irs.gov/.