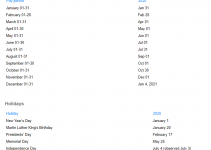

Florida law demands employers to provide their employee a detailed paycheck that will show all of their salary earned in that pay time period, income taxes deducted, and other inclusive details of their pay out period. The payroll check offered to employers should be made available to the employee once or 2 times a month or at the time of payment of salary.

Under Florida law, each September 30, the Agency for Workforce Development calculates an adjustment to the base pay rate based upon the rate of inflation throughout the prior 12 months. The minimum wage is $8.56 and $5.54 for tipped staff members.

Companies covered by Florida’s wage payment law are required to pay their employee by cash, check or perhaps payroll debit card. For the Income Tax Withholding, Florida is among the state that have no state earning state along with other state such as Alaska, New Hampshire, Nevada, South Dakota, Texas, Tennessee, Wyoming and Washington.

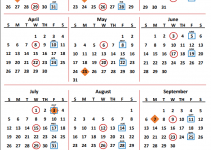

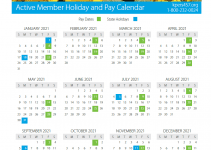

Download 2025 & 2025 Florida Payroll Calendar

[su_button url=”https://www.myfloridacfo.com/Division/AA/StateAgencies/documents/2020AGENCYCalendar-FINAL.PDF” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click here to download manual”]Florida Payroll Calendar[/su_button]