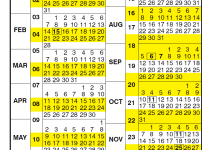

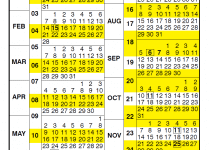

Payroll Calendar Federal 2025 – Payroll calendars are an effective way to keep payroll costs down. This is particularly true if you have employees that are part-time or seasonal. A payroll calendar that is effective will provide you with an easy-to-use tool to track employee pay, benefits, deductions, and other important information.

If you are looking for a payroll calendar that can be used by federal, state and local governments, you will find that the Federal Payroll Calendar offers all of the functionality you need to manage payroll. With this calendar, you can create a pay period, run checks, keep track of benefits and deductions, and more. The calendar can be customized with many different features and is also easy to view.

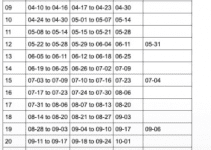

If you plan to use the payroll calendar to keep track of benefits, you will find that there are many different types of benefits you can enter. For example, you can enter in the name of the employee, the type of benefits he or she receives, and the expiration date of the benefits. The calendar can also be customized to include the employee’s Social Security Number.

If you have federal paychecks to distribute, you will find that the Federal Payroll Calendar is an invaluable tool. You can easily enter the employee’s name, date of birth, pay period, benefit type, and many other information so that you can distribute federal paychecks to the employee’s name in a timely manner. If you are the employer, you can also enter in the date the employee receives their federal benefits, and have the calendar automatically distribute their pay to the correct place.

Download Payroll Calendar Federal 2025

[su_button url=”https://www.gsa.gov/buying-selling/purchasing-programs/shared-services/payroll-shared-services/payroll-calendars” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll “] Payroll Calendar Federal 2025 [/su_button]