Washington’s existing living wage is $13.50. Companies om Washington should also comply with federal minimum wage constitutions, which presently sets the federal base pay at $7.25.

Starting January 1, 2025, Washington minimum salary laws need a yearly evaluation of its minimum wage. The minimum wage must be increased by the portion the expense of living has actually altered from the prior September 1 to the September 1 in the year the review is conducted.

In case a company picks to pay staff members base pay, the employer needs to pay those workers in accordance with the minimum wage policy, both federal or state, that results in the staff members being paid the greater wage. In most circumstances in Washington, the Washington minimum wage.

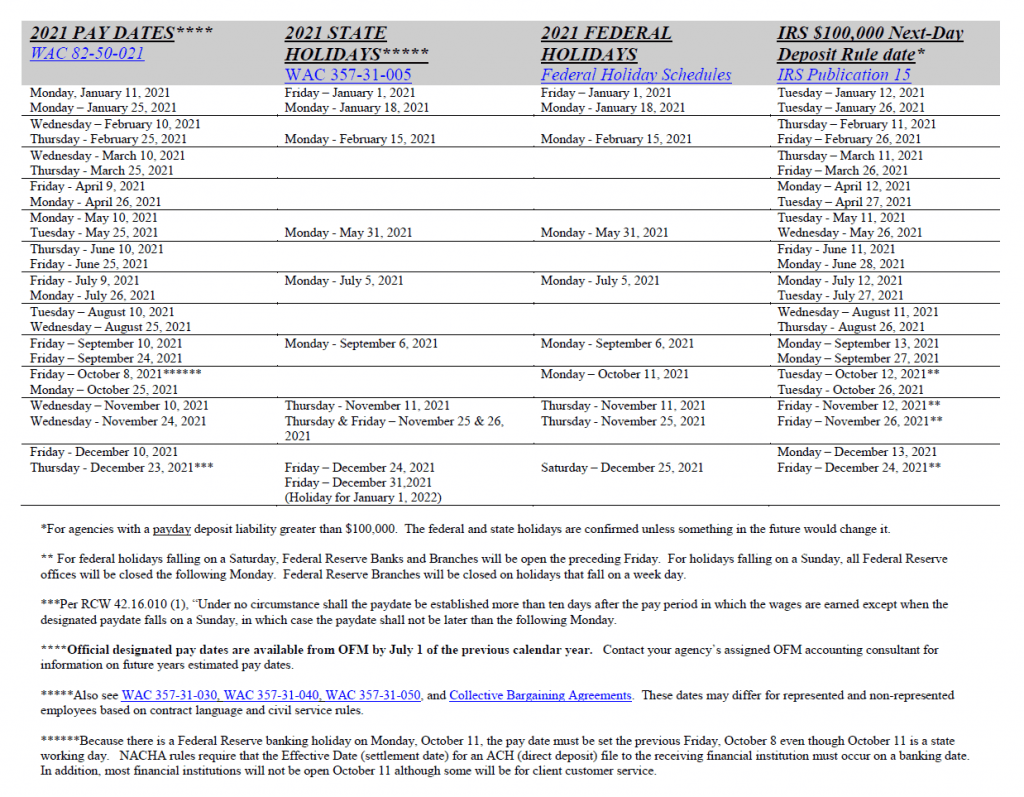

Employers covered by Washington’s wage payment requirement need to pay salaries a minimum of regular monthly on regular paydays. An employer needs to pay employees a minimum of once monthly on recognized paydays. A company must pay workers within 10 days of completion of a pay period. These demands may be changed by a collective bargaining contract. If an employer is unable to identify the overtime earnings due by the established payday, the employer must pay the earnings as quickly as the overtime can be determined.