Texas has no state earnings tax, Having said that, companies after all have a variety of things to bear in mind when it comes down to paying workers and gathering taxes from them. Texas’s present base pay is $7.25.

Texas’s minimum wage policy does not use to staff members covered by the Fair Labor Standards Act; therefore, for many companies and workers, minimum wage commitments are governed by the Fair Labor Standards Act. Texas’s present minimum wage for tipped staff members is $2.13.

State of Texas Payroll Law

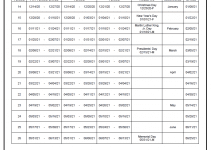

A company needs to pay salaries to each worker who is not exempt from the overtime pay at least two times per month (semi-monthly). A company should pay a staff member exempt from overtime at least as soon as per month. If a company stops working to designate paydays, the company’s paydays are the very first and 15th day of each month.

State of Texas Payroll Calendar 2025

[su_button url=”https://hrportal.hhsc.state.tx.us/PORTAL/documents/Payroll_Calendar_0121.doc” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Texas Payroll Calendar 2025 Word Monthly [/su_button]

[su_button url=”https://fmx.cpa.texas.gov/fmx/calendars/payrollsched/payrollsched21.pdf” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] Texas State Payroll Calendar 2025 PDF [/su_button]