State of Tennessee Payroll Calendar 2025 – Tennessee has not yet set up a state minimum salary rate. The minimum wage established in this law would typically apply because most employees and employers in Tennessee are susceptible to the federal Fair Labor Standards Act. Currently, the federal minimum wage is $7.25.

Tennessee does not have minimum wage and overtime regulations and, therefore, has not yet developed a tipped minimum wage. Since most employees and employers in Tennessee are subject to the federal Fair Labor Standards Act, the requirements for tipped wages established in that law typically apply.

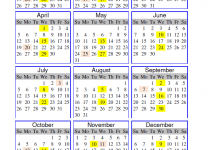

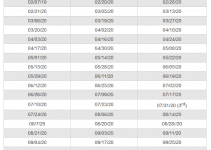

Payroll Calendar Schedule

A company should pay wages as follows:

- Salary earned plus unpaid before the first day of any month need te be paid out no more than after the 20th day of the month following one where the salary made.

- All salary earned and outstanding before the 16th day of the month shall be due and payable not later than the following month’s fifth day.

- A company can pay workers more than two time per month (semi-monthly).

A company should establish and keep regular paydays. It must post and maintain notices, printed or printed in straightforward type or script, in a minimum of two (2) conspicuous places where the workers can view the messages as they go to and from work, setting forth the regular paydays.

Just if an staff is missing from the typical workplace at the time of the salary payment, the company should pay the worker within a reasonable time following the staff’s request for the salaries. In term of Tax Withholding, Tennessee doesn’t mandate income tax withholding.

State of Tennessee Payroll Calendar 2025

[su_button url=”https://hub.edison.tn.gov/psp/paprd/EMPLOYEE/EMPL/h/?tab=PAPP_GUEST” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Tennessee Payroll Calendar 2025 [/su_button]