North Dakota companies must abide by federal base pay regulations, which currently sits at $7.25. If an employer picks to pay employees base pay, the employer needs to pay their employees per the minimum wage law, either federal or state, resulting in the staff members being paid higher wages.

Companies may pay tipped staff members the tipped base pay. A tipped worker is a service staff member who operates in an occupation where the service worker usually and routinely receives more than $30 monthly in tips.

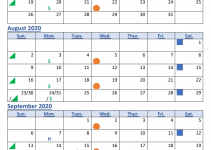

State of North Dakota Payroll Payment Schedule

A company covered by North Dakota’s wage payment policy must pay incomes at least regular monthly on regular paydays assigned ahead of time by the employer.

North Dakota has an earnings tax reciprocity arrangement with Minnesota and Montana’s states, enabling qualified Minnesota and Montana residents to declare exemption from North Dakota earnings tax? To get such exemption, the employee needs to submit Form NDW-R, Affidavit of Residency, for every year the exemption is declared.

Print North Dakota Payroll Payment Schedule.

[su_button url=”https://www.nd.gov/omb/agency/financial/payroll” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of North Dakota Payroll Calendar 2025 [/su_button]