Nevada’s existing base pay is $8.00 for workers who are provided certifying health advantages. It is $9.00 for workers who possess not be provided certifying health advantages. Nevada, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington, as well as Wyoming have no state earnings tax.

Nevada’s legislation demands a yearly evaluation of its base pay. The base pay needs to be raised by the portion the expense of living has actually altered from December 31 in the offered you over the level since December 31. The expense of living modification is based upon the Customer Rate Index released by the Bureau of Labor Stats, U.S. Department of Labor.

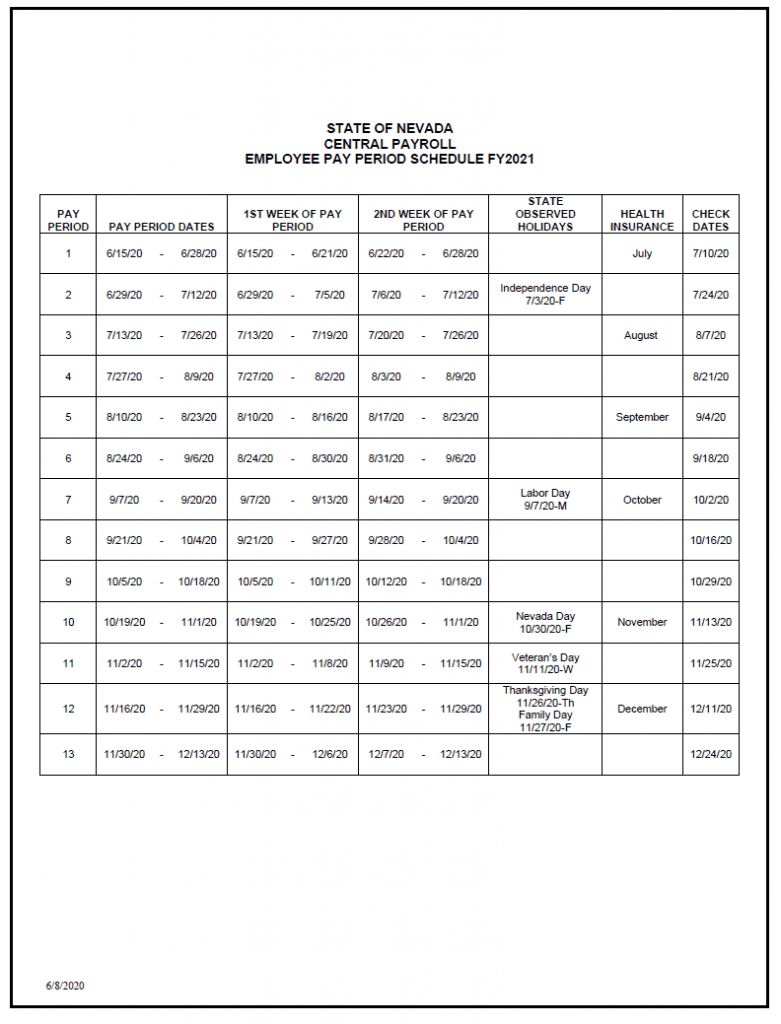

Nevada Payroll Payroll Calendar 2025

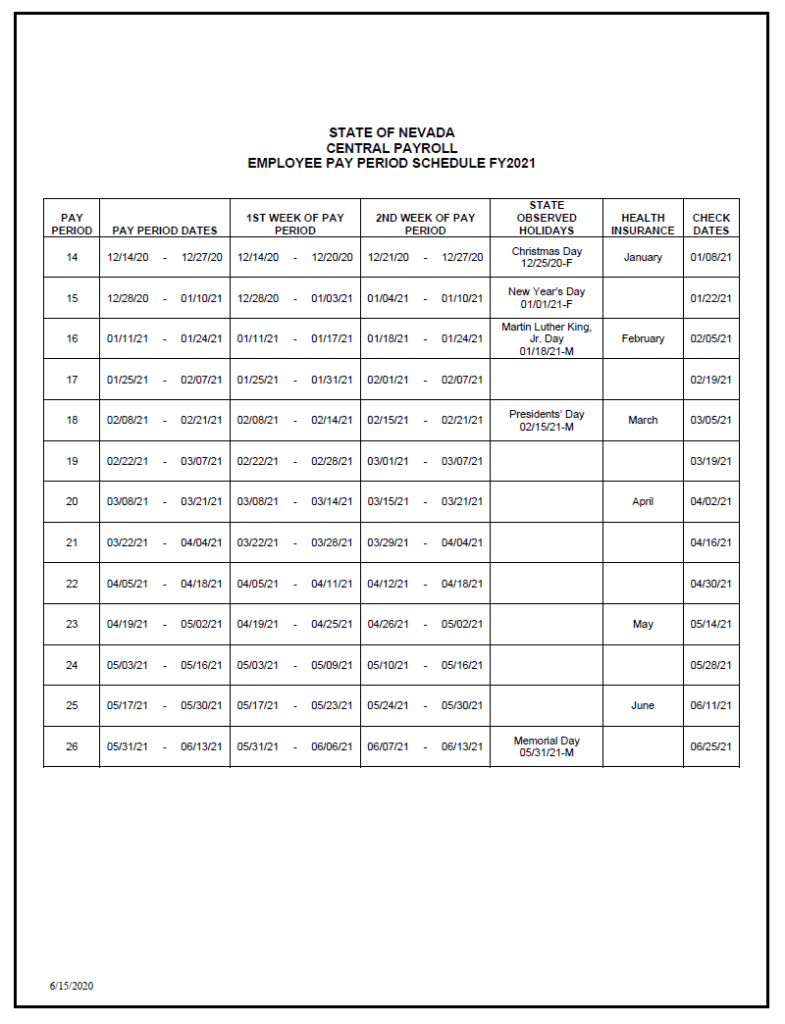

Companies covered by Nevada’s wage payment legislation need to pay incomes a minimum of semimonthly. Salaries made prior to the very first of the month should be paid by 8:00 a.m. on the 15th day of the following month and payment for salaries made prior to the 16th day of the month by 8:00 a.m. on the last day of the month. Workers and companies can settle on another payment schedule, however the arrangement can not be a condition of work.

Nevada State Payroll Calendar 2025