Nebraska’s existing base pay is $9.00 and base pay for tipped staffs is $2.13. Nebraska base pay constitutions do not employ to companies with less than 4 workers. Nebraska companies need to additionally abide by federal base pay constitutions, which right now sets the federal government base pay at $7.25.

In case a company picks to pay workers base pay, the company should pay those staffs based on the base pay policy, either federal or state, which leads to the workers being compensated the greater wage.

Nebraska requests companies to keep salary tax from the incomes of citizens and nonresidents? In the case that a staff is operating in more than one state, the company might be obligated to keep for more than one state for the very same staff.

Nebraska Payroll for Employers

Companies covered by Nebraska’s wage payment constitution need to pay earnings at a designated time, either set by companies or concurred upon with staffs. Companies should offer 1 month’ composed notification of any modification to the designated payday. Staffs missing on payday should be paid as needed at the normal location of payment.

Nebraska Earnings Tax Withholding.

The state mandates companies to keep salary tax from the earnings of locals and nonresidents under the Nebraska Profits Act of 1967.

In the case that a worker is operating in more than one state, the company might be demanded to keep for more than one state for the exact same staff.

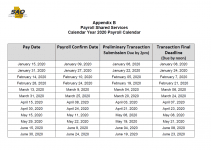

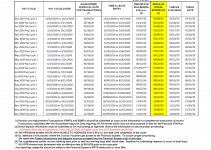

State of Nebraska Payroll Calendar 2025

[su_button url=”https://das.nebraska.gov/accounting/docs/links/payroll/pdf/2021%20BIWEEKLY%20PAYROLL%20SCHEDULE.pdf” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] Nebraska State Payroll Calendar 2025 [/su_button]