State of Mississippi does not have minimum income regulation. Federal lowest wage prerequisites affect employees in the state. employees work in agricultural sector are not subject to withholding in Mississippi. State of Mississippi labor regulations do not demand companies to offer workers with severance pay out. If the company decides to give severance benefits, it must adhere to the terms of its set up policy and employment agreement.

The standard staff salary for the State of Mississippi in 2019 was $40,723. This is 36. % below the nationwide standard for govt employees and 30.8% less than some other states. There are 107,000 payroll records for Mississippi

Mississippi Payroll Payment Income Tax Withholding.

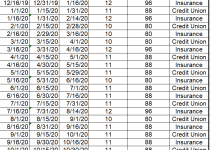

Companies included in Mississippi’s wage payment rules need to pay income at least 2 times month and not more than 15 days right after the close of the pay time. Mississippi’s law calls for businesses to withhold state income tax from staff’s income and pay the amounts taken out to the State Tax Commission.

[su_button url=”https://www.dfa.ms.gov/dfa-offices/mmrs/mmrs-applications/spahrs/payroll-due-dates/” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Mississippi Payroll [/su_button]