Michigan’s existing minimum wage is $9.65. Michigan minimum wage regulations affect companies that use two or more workers over the age of 16 at the same time within a calendar year. Michigan withdrawn it’s Single Business Tax (SBT) plus authorized a Michigan Business Tax (MBT) which has lowered income taxes for seventy percent of Michigan companies.

Michigan Payroll for Employers

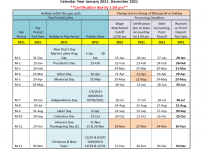

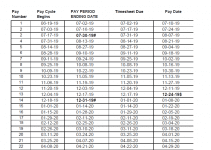

Companies covered by Michigan’s pay payment law should pay salaries a minimum of two times in a calendar month. Payment needs to be made on the very first day of the month for earnings made the very first 15 days of the preceding month and on the 15th day of the month for incomes made from the 16th day to the last day of the preceding month. All workers are covered.

Michigan Earnings Tax Withholding

Michigan requires companies to keep state earnings tax from staff members’ earnings and remit the quantities kept to the Department of the Treasury. Michigan has mutual arrangements with Illinois, Indiana, Kentucky, Minnesota, Ohio, and Wisconsin. Michigan companies are not needed to keep Michigan earnings tax from settlement made in Michigan by citizens of those states.

Other out-of-state companies that have staff members who works in Michigan needs to sign up with the state Treasury Department and keep Michigan earnings tax from all workers working within the state.

[su_button url=”https://www.m1ccu.org/files/mione19/1/file/State%20Pay%20Day%20Calendar%202020.pdf” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Michigan Payroll [/su_button]