Iowa has a mutual withholding commitment with Illinois that permits earnings tax withholding for the staff member’s state of residence just. Iowa’s existing base pay is $7.25 and Iowa labor regulations do not have regulations governing the payment of overtime. Federal overtime polices use.

Iowa’s base pay needs do not apply to companies that have a yearly gross volume of sales made or company done that is less than $300,000, not consisting of any excise tax at the retail level that are taped individually.

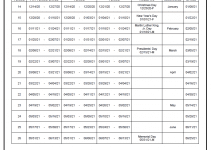

Companies covered by Iowa’s salary payment regulation need to pay salaries a minimum of once a month, semimonthly or biweekly. Payments need to be made not more than 12 days following the close of a pay period, leaving out Sundays and legal holidays.

Iowa needs companies to keep state earnings tax from workers’ salaries and remit the quantities kept to the Department of Profits.

Every company that has a workplace or does business in Iowa which is needed to keep federal earnings tax on any settlement paid in the state needs to keep Iowa private earnings tax from that settlement. Obligation for gathering and remitting the tax rests with the company or withholding representative.

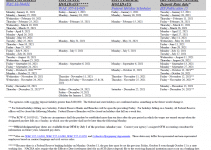

State of Iowa Payroll Calendar 2025

[su_button url=”https://das.iowa.gov/sites/default/files/hr/documents/pre_audit/2020_pay_period_calendar.pdf

” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll “]Iowa State Payroll[/su_button]