A Lot of small business owners think the entire payroll process is straightforward, easy, and simple. Well, it can be simple if everything is done appropriately.

Would you want to do your business’s payroll? If the answer is yes, then you are in for a thrill. Mind you, the process is simple but it can be very tricky. To get started you need to familiarize yourself with some of the payroll lingo and vocabulary. Everything that has to do with payroll is specific, and as such, there is no room for changes or deviations.

So to get started on your payroll journey, you need to know some of these common terms

Payroll

Payroll is quite generic and it has lots of meaning.

- Payroll encompasses the salaries or wages paid to an employee for a specified service.

- The money paid to employees of a business on a payday

- The summation of the annual earnings of employees

- The financial records of a business that has to do with employee salaries and wages

Gross Pay

This is the entire payment of the employee calculated before deductions, and taxes are removed. It is the entire amount paid to an employee during a specified payment period.

Gross Pay is calculated for salary and hourly employees

- Salary Gross Pay: The agreed amount for an employee for a specified payment period usually one year

- Hourly Gross Pay: The employee’s hourly rate multiplied by the total number of hours worked in the payment period.

Gross pay also houses overtime payments.

Net Pay

This is the employee’s gross pay minus deductibles and withholdings. The net pay is what the employee sees on the paycheck on payday.

To calculate net pay, remove all tax withholdings (state and federal), and deductions (health plan, pension, and so on) from the gross pay.

Withholding

Withholding or tax withholdings refers to the amount removed as state and federal income from an employee’s gross pay.

Contract employees: For these types of employees, the employers do not without taxes from their gross pay. Contract employees pay their income taxes at the end of the working year.

Full-time employees: The employer withholds local, state, and federal income taxes from the gross pay. Mind you, withholdings differ among employees. Tax withholdings is determined by the W-4 form submitted during the hiring and onboarding process.

Overtime

This is any additional amounts employees that work above 40 hours weekly. It is also the amount paid to employees who work on weekends or carry out extra tasks outside their job description. In the US, overtime is calculated by adding half of the original hourly to the regular rate.

Let’s say an employee’s regular rate is $16 per hour, the overtime rate will be $16 + $16/2 = $24. So, the overtime pay will be this amount times the hours worked overtime.

Overtime varies between salaried and hourly employees. While hourly employees can receive overtime, salaried employees are prohibited in most businesses.

Pay Periods

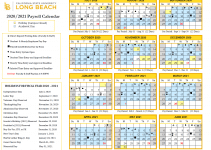

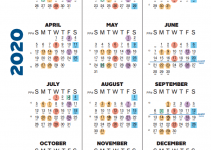

This is a repeated duration of time of which an employee receives payment for the agreed task. Pay periods include weekly, bi-weekly, semi-monthly, and monthly. T

- Weekly: The employee receives 52 pay periods annually

- Bi-weekly: Employee receives 26 pay periods annually

- Semi-monthly: Employee receives 24 pay periods annually

- Monthly: Employee receives 12 pay periods annually.

Having a good knowledge of the pay period yearly is essential for knowing the amount employees are to get during each pay period.

Work Week

This is an uninterrupted 168 hours of work within 7 days. Work week is useful when it comes to overtime calculations

Compensation

Compensation is a term that is often used interchangeably with pay, however, it has a much broader meaning. Compensation includes all forms of payments made to employees. Examples of compensations include;

- Stock options

- Bonuses

- Gifts and awards

- Company vehicle

- Transportation benefits

- Education benefits

- Meals and so on

Salaried Vs Hourly Employees

We already touched on this when explaining hourly and salaried gross pay. Hourly employee or salaried employee simply refers to how employees are paid. Hourly employees receive payment based on an hourly rate multiplied by the number of hours worked. On the other hand, Salaried employees are paid an annual salary based on their Pay Schedule.

Non-exempt and Exempt Employees

These classes of employees are differentiated by the work they do. Exempt here stipulates that the employees cannot work overtime.

Exempt employees work in a professional capacity. Their role includes executive and management positions. Any other employee not in the above categories are non-exempt, and are can work overtime. However, there are some companies that pay exempt employees overtime.

Conclusion

So, there you have it. If you are thinking of doing the payroll of your business, familiarize yourself with these terms. They are easy to remember, and they can be quite useful in everyday conversation around the office. Good luck!