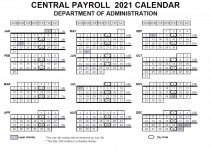

A payroll calendar is a calendar showing the various paydays in a specified period of time. It will normally show the day, hour and minute of the pay period. The calendar will also have a list of the different individuals who are in the payroll queue. You can use the calendar to see who is due for pay.

Time management is a major issue in today’s world. In today’s modern businesses, managers face all kinds of problems in their attempt to coordinate the daily activities of the employees in a systematic manner. This task calls for an elaborate management system which will manage all the different aspects of the business in an organized manner. A good payroll calendar is therefore essential to ensure that all employees are paid on time and are paid correctly and on time.

Many industries today, especially in the corporate sector, like to keep an accounting system for themselves and to make sure that their employees’ payroll details are always in their control. Having a clear and up-to-date knowledge of all the payroll details of the company will help managers stay informed about the current status of the payroll system.

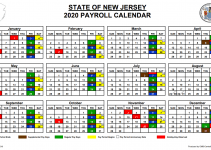

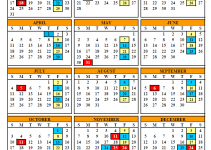

Montana charges a progressive income tax, broken down into seven tax brackets. The 2025 tax rates range from 1% to 6.9%. Employees who make more than $18,400 will hit the highest tax bracket. Montana doesn’t have any local taxes, so you only have to withhold for state taxes

If you are looking for Montana State Payroll Calendar so you can plan your finance, please click the link below download and print it. more information here

Montana State Payroll Calendar 2025

[su_button url=”https://statehr.custhelp.com/app/answers/detail/a_id/278″ style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] Montana State Payroll Calendar 2025 [/su_button]