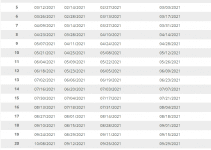

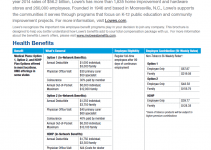

US Department of Labor Payroll 2025 – The payroll department keeps track of all payroll data for an organization. This includes employee payroll stubs, W-2 statements, tax forms, deposits, and more. In addition, this department can also access various computerized systems utilized by payroll providers to store employee details.

The U.S. Department of Labor applies the Fair Labor Requirement Act (FLSA), which establishes standard minimum wage and overtime pay standards. These standards are applied by the Division’s Wage and also Hour Department.

The government base pay is $7.25 per hour for employees protected by the FLSA.

A lot of states also have base pay laws. In cases where a worker undergoes both the state and also government base pay legislations, the employee is qualified to the greater of the two minimum incomes.

Overtime pay of not lower than one as well as one-half times the regular price of pay is called for after 40 hrs of operation in a workweek. Certain exceptions apply to specific sorts of services or particular types of jobs.

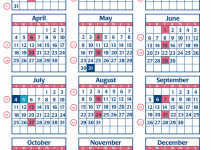

US Department of Labor Payroll 2025

[su_button url=”https://www.dol.gov/agencies/owcp/dfec/regs/compliance/Periodic-Roll-Payment-Schedule” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] U.S. Department of Labor Payroll Calendar 2025 [/su_button]