Navigating Your Paydays: Understanding the ADP Payroll Calendar 2025

For businesses of all sizes, ensuring timely and accurate payroll is paramount. It’s not just about compliance; it’s about keeping your employees happy and maintaining a smooth operational flow. One of the key tools in achieving this is a well-defined payroll calendar. If your organization utilizes ADP for payroll processing, understanding the ADP Payroll Calendar 2025 is crucial for effective planning and execution.

This comprehensive guide will delve into the significance of the ADP Payroll Calendar 2025, how it functions, and key considerations for both employers and employees.

Why is the ADP Payroll Calendar 2025 Important?

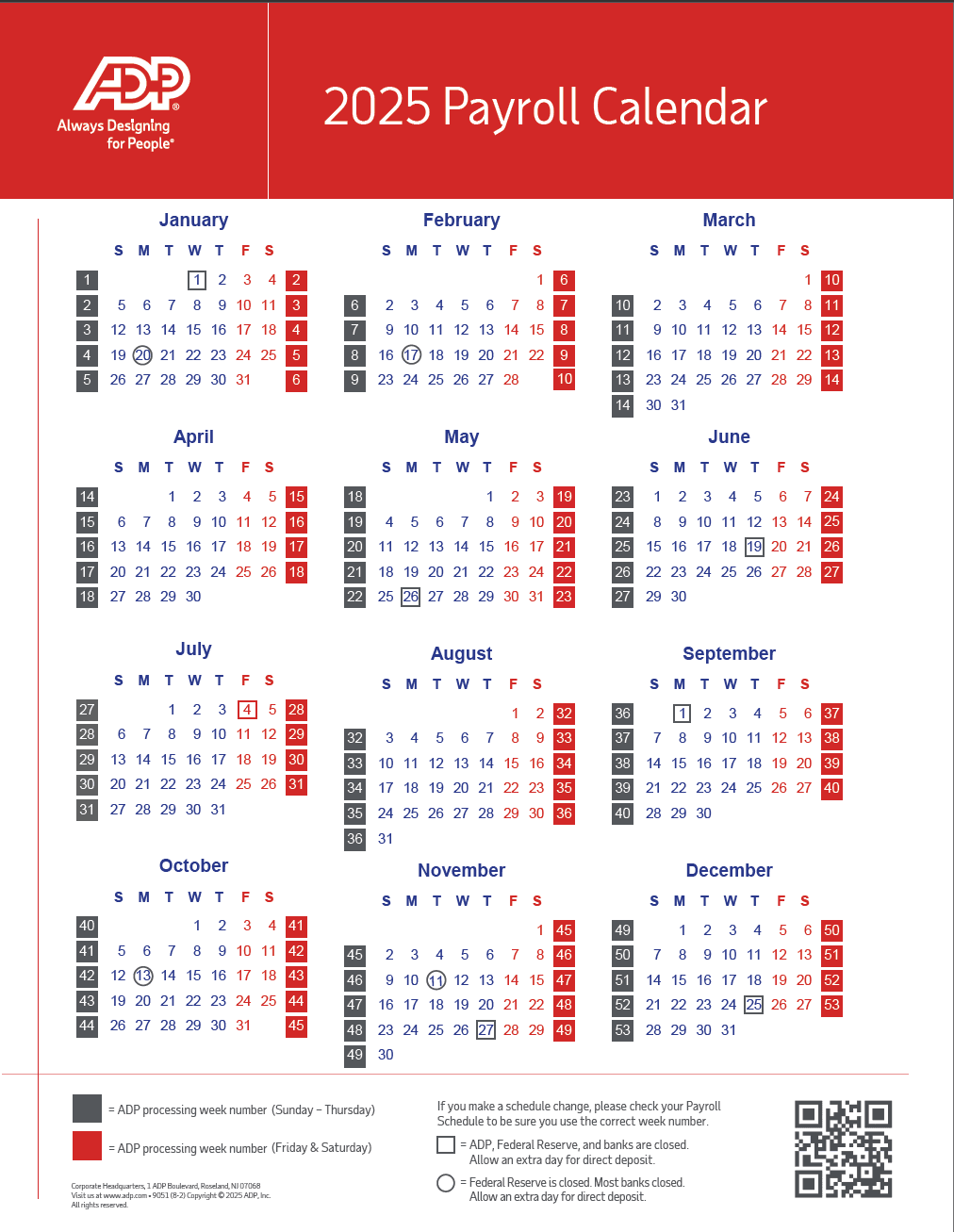

The ADP Payroll Calendar 2025 serves as a roadmap for all your payroll-related activities throughout the year. It outlines critical dates, including:

- Pay Dates: The specific days employees will receive their paychecks.

- Cut-off Dates: The deadlines by which payroll information (hours worked, deductions, etc.) must be finalized and submitted for processing.

- Processing Dates: The timeframe ADP requires to calculate and prepare payroll.

- Holiday Schedules: How company holidays might affect payroll processing and pay dates.

- Tax Filing Deadlines: Important dates for remitting payroll taxes to the relevant authorities.

Having a clear understanding of this calendar offers numerous benefits:

- Ensures Timely Payments: Knowing the exact pay dates allows employees to manage their finances effectively and fosters trust in the organization.

- Facilitates Accurate Payroll Processing: Adhering to cut-off dates ensures that all necessary information is submitted on time, minimizing errors and delays.

- Streamlines Workflow: Both HR and finance departments can plan their tasks and schedules around the payroll calendar, leading to a more efficient process.

- Supports Compliance: Awareness of tax filing deadlines helps businesses avoid penalties and maintain regulatory compliance.

- Improves Employee Relations: Consistent and on-time payments contribute significantly to employee morale and satisfaction.

- Aids Financial Planning: Businesses can use the payroll calendar for cash flow forecasting and financial planning.

Understanding How the ADP Payroll Calendar 2025 Works

While the general principles remain consistent, the specific dates on your organization’s ADP Payroll Calendar 2025 will depend on several factors, including:

- Pay Frequency: Whether your employees are paid weekly, bi-weekly, semi-monthly, or monthly.

- Day of the Week for Payday: The standard day of the week your company has designated for issuing payments (e.g., every Friday).

- Company Holidays: If a scheduled payday falls on a company holiday, the actual pay date might be adjusted (typically to the preceding business day).

- Processing Time: ADP requires a certain number of business days to process payroll after the cut-off. This processing time can vary slightly depending on the complexity of your payroll and the services you utilize.

- Banking Holidays: Bank holidays can also impact the timing of direct deposits. If a scheduled payday falls on a bank holiday, funds might be available on the following business day.

Key Considerations for Employers

As an employer, it’s crucial to:

- Obtain and Distribute the Calendar: Ensure you have access to your organization’s specific ADP Payroll Calendar 2025. This is usually available through your ADP portal or by contacting your ADP representative. Once obtained, make it readily accessible to all employees.

- Communicate Cut-off Dates Clearly: Emphasize the importance of adhering to cut-off dates for submitting timesheets, expense reports, and any other payroll-related information. Late submissions can lead to delays in payment.

- Plan for Holidays: Be proactive in communicating any changes to pay dates due to company or bank holidays well in advance.

- Train Employees on Payroll Procedures: Ensure employees understand the payroll process, including how to access their pay stubs and report any discrepancies.

- Utilize ADP Resources: ADP offers various resources and support materials to help you navigate the payroll calendar and address any questions.

Key Considerations for Employees

As an employee, understanding the ADP Payroll Calendar 2025 empowers you to:

- Plan Your Finances: Knowing your pay dates allows you to manage your bills and expenses effectively.

- Understand Payday Variations: Be aware that holidays might shift your usual payday.

- Submit Information on Time: Ensure you submit your timesheets and any other required information before the cut-off dates to avoid delays in your pay.

- Know Where to Find Information: Familiarize yourself with where the payroll calendar is located and who to contact if you have any payroll-related questions.

- Review Your Pay Stubs: Regularly review your pay stubs to ensure accuracy and report any discrepancies promptly.

Accessing Your ADP Payroll Calendar 2025

The most reliable way to access your organization’s specific ADP Payroll Calendar 2025 is through your company’s ADP portal. Typically, you can log in to your ADP account online and find the payroll calendar within the employee or administrator sections. If you are unable to locate it, reach out to your HR department or your designated ADP administrator. They will be able to provide you with the necessary information.

The ADP Payroll Calendar 2025 is an indispensable tool for ensuring accurate and timely payroll processing. By understanding its key dates and how it functions, both employers and employees can contribute to a smoother and more efficient payroll experience. Proactive communication and adherence to deadlines are essential for maximizing the benefits of this crucial resource. Make sure to obtain your organization’s specific calendar and utilize it effectively throughout the year.