Vermont’s existing base pay is $10.96. For the year starting January 1, 2019, and every year afterward, Vermont base pay regulations will need a yearly evaluation of its base pay. The base pay should be increased by the smaller sized of the following:

- 5 percent; or

- The portion boost of the Consumer Price Index, CPI-U, U.S. city average, not seasonally changed, or follower index, as computed by the U.S. Department of Labor or follower firm for the 12 months preceding the previous September 1.

The base pay should not be lowered and should be rounded to the closest $0.01. Any modification to the base pay works on January 1 of the list below year. VT Statute 21-384( a).

Vermont companies need to also abide by federal base pay policies, which presently sets the federal base pay at $7.25.

In case that a company selects to pay staff members base pay, the company should pay those staff members per the base pay policy, either federal or state, that leads to the workers to get the greater wage. In Vermont’s many circumstances, the Vermont base pay will use as it usually ensures a greater wage rate for workers than federal policy.

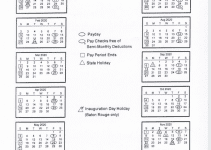

State of Vermont Payroll Calendar 2025

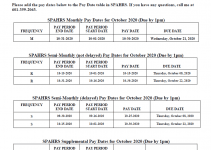

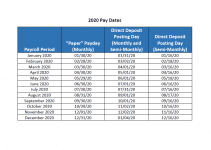

A company needs to pay workers their earnings as soon as they have provided staff members composed notification. A company might pay staff members bi-weekly (as soon as every two weeks) or semi-monthly (twice each month). Incomes need to be paid within six days of the last day of the pay period.

Nonresidents operating in Vermont get Vermont withholdings calculated on their whole profits and decreased by the quantity kept for other states where services were carried out.

[su_button url=”https://humanresources.vermont.gov/compensation/pay-periods” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Vermont Payroll Calendar 2025 [/su_button]