State of Utah Payroll Calendar – Utah’s existing base pay is $7.25. Utah’s base pay for tipped staff members is $2.13. Utah base pay regulations offer the Utah Labor Commission authority to establish the base pay; nonetheless, the Labor Commission might not set the base pay to be more than the government base pay stated in the Fair Labor Standards Act. Utah minimum wage regulation exempt all worker qualified to base pay the Fair Labor Standards Act; hence, since many staff members in Utah go through the Fair Labor Standards Act. The arrangements of Utah’s base pay regulation do not put on many workers operating in Utah.

Payroll Schedule Payment.

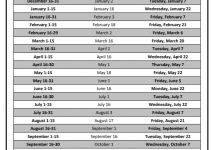

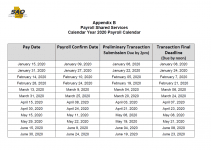

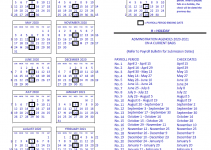

A company needs to pay its staff members, other than annual employed staff members, no much less regularly than semi-monthly (twice each month) on paydays appointed ahead of time.

A company has to pay its non-yearly-salaried workers within ten days after completion of a pay period. The company has to pay its workers on the day before those days if a payday drops on a Saturday, Sunday, or lawful vacation.

As soon as per month, a company might pay a yearly-salaried worker. The company should pay its yearly-salaried staff members on or before the 7th day, complying with the month in which the incomes were made when paying when per month.

Utah Income Tax Withholding.

Utah calls for companies to keep state earnings tax from their workers’ earnings and also pay the quantities kept to the State Tax Commission.

State of Utah Payroll Calendar 2025

[su_button url=”https://dhrm.utah.gov/wp-content/uploads/2021-Pay-Periods-and-Holidays_Rev-7-31-2020.pdf” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] State of Utah Payroll 2025 [/su_button]