Missouri’s existing base pay is $9.45.

Over the next few years, State of Missouri’s will increase their minimum wage as follows:

- January 1, 2025 – $10.30

- January 1, 2025 – $11.15

- January 1, 2025 – $12.00

Starting January 1, 2025, Missouri is going to raise or reduce its base pay by the percent the expense of living has actually altered from the previous July to the July in the year the evaluation is carried out. The evaluation is performed on September 30 of every year and the expense of living modification is based upon the Customer Rate Index for Urban Wage Earners and Clerical Employees (CPI-W). Any modification to the base pay works on January 1 of the next year.

In the case that a company picks to pay workers base pay, the company needs to pay those staff members in accordance with the base pay policy, either federal or state, that leads to the workers being paid the greater wage. In a lot of circumstances in Missouri, the Missouri base pay will use as it normally ensures a greater wage rate for staff members than federal requirement.

Missouri Payroll for Employers.

Companies covered by Missouri’s wage payment policy should pay salaries a minimum of semi-monthly. Every enterprises and producers doing service in the state are covered.

Missouri Earnings Tax Withholding.

Missouri mandates companies to keep state earnings tax from workers’ incomes and remit the quantities kept to the Department of Revenue, Department of Tax and Collection.

Every company that has a workplace or does organization in the state and pays incomes should keep Missouri earnings tax from incomes paid to covered staff members.

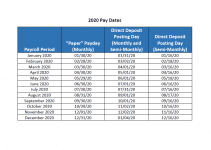

Download Missouri State Payroll Calendar 2025 & 2025

[su_button url=”https://samii.mo.gov/sites/samii/files/SAMIIProcSched2020.pdf

” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click to download payroll”] Missouri State Payroll Calendar 2025 [/su_button]